FREQUENTLY ASKED QUESTIONS

-

ELECTRIC VEHICLE CHARGING SYSTEM (EVCS) OR EV HOME CHARGER

1. What should I do before installing an EV home charger?

- Appoint a licensed wireman or electrical contractor registered with the Energy Commission (ST) to check your home’s total electricity usage, including the EV charger.

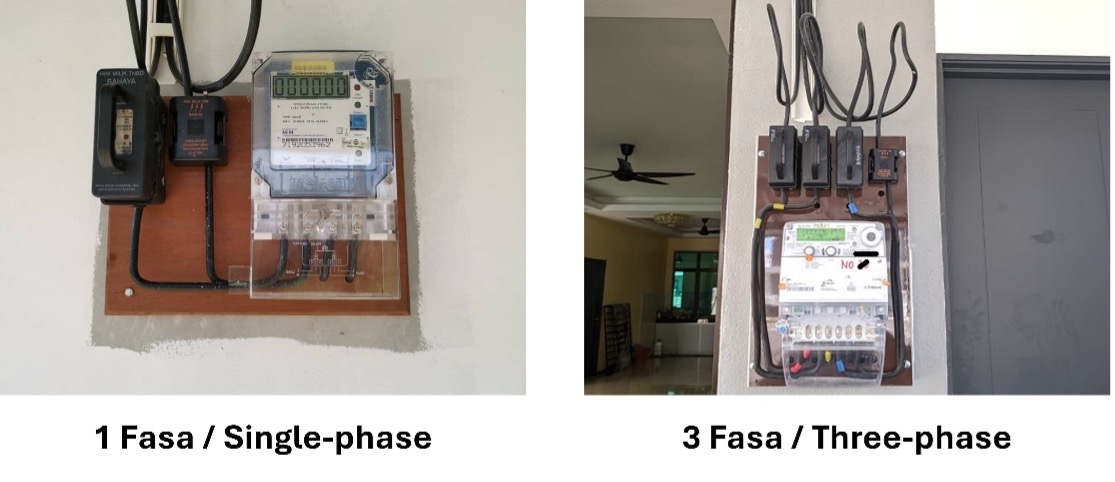

- TNB electricity supply types:

- Single-phase: Suitable for homes with total usage up to 10 kW

- Three-phase:Suitable for homes with usage above 10 kW up to 37 kW

- The EV home charger must be connected using a dedicated circuit from your home’s distribution board (DB).

2. Do I need approval from TNB to install an EV home charger?

- No approval from TNB is required to install an EV home charger.

- However, if your home needs to be upgraded from single-phase to three-phase supply, you will need to apply to TNB for the upgrade.

3. Do I need to upgrade my electricity supply to install an EV home charger?

- This depends on your home’s total electricity usage:

- If the total usage does not exceed 10 kW, your current single-phase supply is sufficient.

- If the total usage exceeds 10 kW, an upgrade to three-phase supply is required.

4. How can I check my current TNB electricity supply at home?

- Single-phase supply: 2 wires connected to your TNB meter.

- Three-phase supply: 4 wires connected to your TNB meter.

5. How can I check my home’s current electricity usage?

- You can view your usage details in the myTNB app, available for customers with smart meters.

6. Who can help me check my electricity usage and EV charger requirements?

- A licensed wireman or electrical contractor registered with ST can help assess your current usage and advise on any upgrades needed.

7. How do I apply to upgrade my TNB electricity supply?

- Visit https://www.mytnb.com.my/residential/get-electricity/upgrade-downgrade-electricity for step-by-step guidance.

8. How much does it cost to upgrade my electricity supply?

- Sample cost calculations are available on the myTNB website via https://www.mytnb.com.my/residential/get-electricity/upgrade-downgrade-electricity. Please note that internal wiring costs inside your home are not included and will be charged separately by your contractor.

9. What happens if I don’t upgrade my supply even though my usage is too high?

- You may experience frequent power trips or outages due to electricity overload, which can affect your home appliances.

10. Can a contractor upgrade only the fuse without applying to TNB?

- No. This is not allowed. Any changes to TNB’s meter or fuse are strictly prohibited, as they can be unsafe and may cause fire risks.

-

SOLAR ACCELERATED TRANSITION ACTION PROGRAMME (SOLAR ATAP)

Pre Installation

I’m planning to install solar. What are my options?

If you’re planning to install solar, you can generate your own electricity and reduce your bill. To get the most benefit of the solar installation, we recommend you also apply for Solar ATAP Programme.

The Solar ATAP Programme, introduced on 1 January 2026, provides a cost-neutral and transparent mechanism for customers to install and operate solar photovoltaic (PV) systems for self-consumption, while allowing surplus energy to be exported to the grid. This programme is a continuation of the existing Net Energy Metering (NEM) Programme which ended 30 June 2025.

Why apply for Solar ATAP?

• By generating your own electricity, you will use less energy from TNB. Therefore, this will help to lower your monthly electricity bill.

• Additionally, any excess energy you export to TNB, you will receive an ATAP credit. These credits are used to offset your electricity bill, helping you save even more.

• Solar ATAP credits will be credited in the same month of TNB bill based on the energy rate for Domestic customers or average System Marginal Price (SMP) for Non-Domestic customers.

How do I know if I’m eligible for Solar ATAP Programme?

All registered TNB customers are eligible to apply for Solar ATAP except the following:

- The applicant is a participant of the Feed-in Tariff (“FiT”) programme.

- The applicant is a participant of Net Energy Metering (NEM) programme or a customer with solar PV installation for self-consumption. Customer needs to terminate their current contract prior to joining Solar ATAP.

- Any customer who is also a generator such as but not limited to co-generator (CoGen) and backfeed.

- The applicant is a multi-tenant customer.

How do I apply for Solar ATAP Programme?

You need to appoint a Registered Photovoltaic Service Provider (RPVSP). The RPVSP will assist you with the end-to-end application process for Solar ATAP. Click here to find your RPVSP.

I have received approval from SEDA for my application. What do I do next to apply from TNB?

Your RPVSP must complete the solar PV installation first and then submit your Solar ATAP application.

RPVSPs can submit Solar ATAP application for their customers via myTNB Portal here.

How much do I need to pay for solar PV installation and how much savings will I gain?

The cost of installing solar PV system and the savings gained from using solar energy depend on the solar PV system size you installed and your electricity consumption. A typical terrace house solar PV installation is about 6 to 8kWp. If the cost of solar panels is RM3,000 per kWp, then the total investment is about RM18,000 to RM24,000.

To calculate your savings with the Solar ATAP Programme, here are the examples of comparison for a Domestic customer without solar and with 5kWp solar capacity installed:

Without Solar

Estimated energy consumed from TNB grid (kWh/month) 800 Your monthly bill without solar installation (RM) 345.89 Total bill for 1 year without solar installation (RM) 4150.68

With Solar (based on estimated monthly consumption of 800kWh)

Solar PV Capacity (kWp) 5 Total investment (RM3,000/kWp) 15,000.00 Estimated solar generation (kWh/month) (kWp x 3.5hour x 30days) 525 Estimated solar energy used for self-consumption (SELCO) if 75% used (kWh/month) (75% x 525k kWh) 394 Estimated energy usage from TNB grid after SELCO (kWh/month) (800kWh – 394 kWh) 406 Excess energy generated exported to TNB grid (kWh/month) which is the balance of 25% of the solar generation (25% x 525 kWh) 131 Your bill is calculated based on the energy imported from TNB Grid and after being offset with the excess energy exported to TNB Grid. (406 kWh x Prevailing Tariff) – (131 kWh x Energy Rate RM0.2703/kWh) 107.08 Savings (RM/month) 238.81 Savings (RM/Year) 2,865.72 Payback period for your solar PV investment (RM15,000 / RM2,865.72) ~5.2 years

Here are another examples of comparison for a Non-Domestic customer without solar and with 500kWp solar capacity installed:

Without Solar

Maximum Demand (kW/month) 500 Estimated energy consumed from TNB grid (kWh/month) 300,000 Your bill without solar installation (RM) 136,471.00

With Solar Installation

Solar PV Capacity (kWp) 500 Total investment (RM3,000/kWp) 1,500,000.00 Maximum Demand (kW/month) 500 Estimated solar generation (kWh/month) (kWp x 3.5hour x 30days) 52,500 Estimated energy consumed from TNB grid (kWh/month) 300,000 Estimated solar energy used for self-consumption (SELCO) if 75% used (kWh/month) (75% x 52,500 kWh) 39,375 Estimated energy usage from TNB grid after SELCO which is the balance of 25% (kWh/month) (300,000 kWh – 39,375 kWh) 260,625 Excess energy generated exported to TNB grid (kWh/month) (52,500 kWh – 39,375 kWh) 13,125 Your bill is calculated based on the energy imported from TNB Grid and after being offset with the excess energy exported to TNB Grid. (260,625 kWh x Prevailing Tariff) – (13,125 kWh x Average SMP Rate RM0.20/kWh) 121,912.51 Savings (RM/month) 14,558.49 Savings (RM/Year) 174,701.88 Payback period for your solar PV investment (RM1,500,000 / RM174,701.88) ~8.5 years Is there any financing option to install my solar?

Besides outright purchase, you can sign an agreement with a Registered Photovoltaic Investor (RPVI) to finance your solar PV system installation. Click here for further information.

You can also contact our subsidiary for a free consultation, click here.

Are there any other applicable charges I have to pay when my Solar ATAP application is submitted to TNB?

The applicable charges depend on your TNB voltage supply as below:

- Meter Cost per meter only applicable for large power customers

- Meter service charge is applicable if no meter replacement required and only applicable to large power customers

- Stamp duty charge of RM10 is applicable unless exempted under the act (example: government account)

Meter Replacement Required? Ordinary Power Consumer (OPC) Large Power Consumer (LPC) 230V or 400V Low Voltage 400V Low Voltage 6.6kV - 33kV Medium Voltage 132kV - 500kV High Voltage YES (Price Per Meter) RM0 RM1,530 RM2,330 RM4,660 NO (Meter Service Charge Applicable) RM0 RM180 RM420 Post Installation

How long is my Solar ATAP contract with TNB?

The Solar ATAP contract is valid for ten (10) years from the Solar ATAP Commencement Date and will expire on the last day of the month on the 10th year of the contract.

Example: If the Solar ATAP Commencement Date is on 15 March 2026, the Solar ATAP contract will end on 31 March 2036.

After ten years, the solar PV Installation shall be strictly used for self-consumption at the premises where the solar PV is installed. Any excess energy supplied to TNB grid will no longer be eligible for Solar ATAP credit.

When can I turn on my solar?

You can turn on your solar PV system after you receive Solar ATAP Welcome Letter from TNB. Otherwise, you will not be eligible for Solar ATAP credits for any excess energy you supply to TNB during the period before Solar ATAP Commencement Date as stated in the Welcome Letter.

Why is the export reading in my bill different from my solar PV provider’s mobile/web platform?

TNB meter and solar PV provider’s mobile/web platforms measure solar energy at different points. The solar PV provider’s mobile/web platform measures the total solar energy generated, while TNB meter only measures the excess solar energy exported to TNB grid after you use the energy for your own consumption.

What is Maximum Allowable Quantity (MAQ) and how it is derived?

Maximum Allowable Quantity (MAQ) is the maximum solar energy generated and exported to TNB in the current billing period.

As defined in the Solar ATAP Guideline, it is derived based on:

Solar Capacity (kWac) x 5 Sun Hours x Billing Period How is my ATAP credit calculated every month?

You can obtain the Solar ATAP credit in the current month based on your usage from TNB or Maximum Allowable Quantity (MAQ), which one lower.

Example 1 (If your usage is lower than calculated MAQ, your excess generation is capped at your usage):

Your usage = 500kWh

Your excess generation = 600kWh

Calculated MAQ = 700kWh

Your eligible ATAP Credit = 500kWh * Energy Rate or Average SMP Rate

Example 2 (If your usage is higher than calculated MAQ, your excess generation is capped at MAQ):

Your usage = 500kWh

Your excess generation = 600kWh

Calculated MAQ = 400kWh

Your eligible ATAP Credit = 400kWh * Energy Rate or Average SMP Rate

Why am I being charged with Automated Fuel Adjustment (AFA) even though I am supplying energy to TNB?

You will be charged with AFA because you may use energy from TNB at night which is subjected to AFA. The AFA charge may be in the form of a rebate or surcharge.

For Solar ATAP customers, AFA is calculated based on the total imported kWh, as approved by the Energy Commission and stated in the Solar ATAP Guideline. AFA applies to Domestic customers with monthly consumption above 600 kWh and all Non-Domestic customers.

Click here for more information on AFA.

Can I use the Solar ATAP balance to offset my bill next month?

Any unutilised Solar ATAP credit in the same billing period is not allowed to be carried forward as stated in the Solar ATAP Guideline.

Can I exchange the electricity I export or unutilised Solar ATAP credit for cash?

No. There is no cash transaction for the export of energy and the unutilised Solar ATAP credit.

Can I upgrade my solar PV system size?

Yes. You can upgrade your solar PV size, subject to the capacity limit. You need to appoint RPVSP to process your request and obtain approval from SEDA.

I would like to sell my house. Can I transfer my Solar ATAP ownership to the new owner?

Yes, subject to approval from SEDA. However, any unutilised Solar ATAP balance will be forfeited and cannot be transferred to the new owner.

-

NET ENERGY METERING (NEM)

I want to install solar under NEM. What do I need to do?

You need to appoint a Registered Photovoltaic Service Provider (RPVSP).

RPVSP will assist you with the end-to-end application including for NEM. Click here to find your RPVSP.

How much do I need to pay for solar installation and how much savings will I gain?

The cost to install solar and the savings gained from using solar energy will depend on the solar size you install. You can use your monthly TNB bill for the estimation. Click here for further info.

Is there any financing option to install my solar?

Besides outright purchase, you can sign an agreement with a Registered Photovoltaic Investor (RPVI) to finance your solar PV system installation. Click here for further info.

You can also contact our subsidiary for a free consultation, click here.

I have received an email from SEDA informing about my NEM Quota. How do I apply for NEM meter?

Your RPVSP needs to complete the solar installation first and then submit your NEM application via myTNB portal. We will process your NEM application accordingly and if everything is in order, we will notify you of the meter installation date, if applicable. You will receive an email containing NEM Welcome Letter as confirmation of your successful NEM application.

Do I need to pay for the NEM application with TNB?

You need to pay the RM10 stamp duty cost. Additional charges may apply depending on the meter type and voltage level, if applicable.

When can I turn on my solar?

You can turn on your solar PV system after you receive NEM Welcome Letter from TNB. Otherwise, you will not enjoy NEM credit for any excess energy you supply to TNB during the period before NEM Commencement Date (NEMCD) as stated in NEM Welcome Letter.

How long is my NEM contract with TNB?

The NEM contract is for a period of ten (10) years from the NEM Commencement Date (NEMCD) and will expire on the last day of the month on the 10th year anniversary for NEM 3.0 consumers.

Example: If the NEMCD is on 15th March 2023, the NEM contract will end on 31st March 2033.

After ten years, the solar PV Installation shall be strictly used for self-consumption on the premises where the solar PV installation is installed. Any excess energy supplied to TNB grid will no longer be eligible for NEM credit.

Why is the export reading in my bill different from my solar apps?

TNB meter and solar apps measure solar energy at different points.

Solar apps measure the solar energy generated, while TNB meter only measures the excess solar energy exported to TNB grid after you use the energy for your own consumption.

How do I get credit from my NEM export?

Your NEM export will be credited in the same month’s TNB bill based on your NEM category:

- for NEM 1.0, 1 unit of export will be multiplied by a fixed rate at either RM0.31 or RM0.238 depending on the voltage level

- for NEM 2.0 / NEM 3.0 Rakyat / NEM 3.0 GoMEn, 1 unit of export will offset 1 unit of import

- for NEM 3.0 NOVA, 1 unit of export will be multiplied by the Average System Marginal Price (SMP)

Why am I being charged with ICPT even though I am supplying energy to TNB?

You are still using energy from TNB for example at night which is subjected to ICPT. The ICPT charge may be in the form of a rebate or surcharge.

The calculation of ICPT for NEM consumers is based on total kWh import as approved by the Energy Commission and stated in NEM Guideline.

Click here for more info.

Why does my NEM balance expire even though it is less than 12 months?

The first year may not be a full twelve (12) months. For example, if your solar commencement date is in July 2023, then the NEM balance will expire on 31st December 2023 which is only a six (6) months period.

Can I exchange the electricity I export for cash?

There is no cash transaction for the export energy. Any excess energy is only eligible for NEM credit as mentioned in Question (9) above.

Can I upgrade my solar size?

You can upgrade your solar size subject to quota availability and capacity limit. You need to appoint RPVSP to process your request and obtain approval from SEDA.

I would like to sell my house. Can I transfer my NEM ownership to the new owner?

Yes, but you need to apply for approval from SEDA first. Any NEM balance will be forfeited if not utilized and cannot be transferred to the new owner.

I want to close my Electricity Account, but I still have the NEM balance. What happens to my NEM balance?

Your NEM balance will offset the final bill. If there is still any excess, it will be forfeited.

-

FEED-IN TARIFF SCHEME

What is the Feed-In Tariff (FiT)?

FiT pays you for the extra electricity your solar PV system produces, that you don’t use, and instead goes back into the grid. FiT is a system under the Renewable Energy Policy and Action Plan and the Renewable Energy Act 2011 to pump up the production of renewable energy in Malaysia up to 30 megawatts.

What is the objective of FiT?

The objective of the FiT scheme is to encourage people to participate in renewable energy so we can decrease our carbon emissions and at the same time save money. The FiT scheme has been a great success in many countries including Germany and Spain, and is a major reason behind Renewable Energy growth.

When was the FiT System launched?

2011.

Which renewable resources are eligible under FiT?

The following RE resources will be eligible for FiT:

- Biogas (including landfill gas & sewage);

- Biomass (including solid waste);

- Small hydropower;

- Solar photovoltaic;

- Geothermal

What are the guidelines for FiT application?

You can download the application guidelines here.

How can I apply for the FiT?

Applications can be made via SEDA Malaysia’s official website. Please check SEDA Malaysia’s website regularly for notification on the application guidelines.

How does FiT work?

The FiT System provides a fixed payment from distribution licensees for every kilowatt hour (kWh) of renewable energy generated and a guaranteed minimum payment for every kWh exported to the grid. As a clean energy “generator”, you sell clean electricity for a fixed number of years. The exact duration will depend on the type of renewable resource you use to generate electricity.

Who manages the FiT System?

The FiT System is managed by the Sustainable Energy Development Authority Malaysia SEDA Malaysia. SEDA is a statutory body under the Ministry of Energy, Green Technology and Water, established under the Sustainable Energy Development Authority Act 2011.

Why is the task of implementing the FiT System not given to the Energy Commission? Why does the Government require another agency?

The Energy Commission is the sole body regulating and promoting all matters relating to the electricity and gas supply industries in Malaysia. Given its sizeable portfolio, the Energy Commission would face a constraint in resources if it is expected to also discharge the full functions of a feed-in tariff implementing agency. This is why SEDA Malaysia has been set up as an agency dedicated to serving as a one stop renewable energy centre.

What are indigenous resources?

Indigenous means renewable resources within the country and not imported from neighbouring countries.

Is solar thermal eligible for FiT?

No, currently, there is no FiT for electricity generated using solar thermal resources.

Is wind energy eligible for FiT?

No, currently, there is no FiT for electricity generated by wind.

What are the rates for FiT?

The rates for various renewable resources as well as their individual effective periods and degression rates are in the schedule to the Renewable Energy Act 2011. You can refer to SEDA for details.

Is there a quota on the amount of renewable energy I can generate under FiT?

Yes, there is a maximum amount that you are allowed to generate under the FiT system. The quota depends on the type of renewable resources their capacity.

What is grid parity? What is the situation in Malaysia?

Grid parity is when the cost of producing electricity from renewable resources is the same or cheaper than electricity produced from fossil fuels or nuclear energy. Our goal is to reach grid parity with different renewable energy technologies.

What’s displaced cost, and how is it relevant to me?

The displaced cost under the Renewable Energy Act 2011 is the cost of generating and supplying electricity from conventional fossil fuel sources up to the point of interconnection with the consumer. It will not affect potential renewable energy developers and NO, you do not have to deduct this from your FiT rates.

The displaced cost of electricity is only relevant to distribution licensees and the Authority where on a monthly basis, the distribution licensee will claim the positive difference between the FiT payment and the displaced cost, for all renewable energy generated power, from the Authority.

What is tariff “degression”?

Tariff degression is like an “early bird” reward. It means that every year, the renewable energy tariff is reduced. The rate depends on the maturity of the technology and its potential to reduce cost.

Example:

Let’s say, you install a solar PV system in 2019, and sign an agreement with TNB with a FiT rate of RM1.75 per kWh for 21 years. This means you will be selling your PV electricity at RM1.75 per kWh for the next 21 years.Let’s say, one year later your neighbour decides to follow you and sign an agreement with TNB. The FiT rate would have been reduced by 8%, which is RM1.61 per kWh. So, your neighbour will be selling his/her PV electricity at RM1.61 per kWh for the next 21 years.

Why has Malaysia chosen the FiT System? Which other countries are using this system?

MWe chose this system because it is effective and efficient in developing new markets for renewable energy. This system is simple, with low administrative costs.

Germany was the first country to adopt the FiT System. In the first 10 years, they increased their renewable energy capacity and became the world leader in renewable energy which was 16.1% of their total electricity consumption! They also created 300,000 green jobs.

Other countries that have used it with much success:

USA, Australia, China, Brazil, Greece, Iran, Israel, South Korea, South Africa, Taiwan, India, Mongolia, Thailand, Philippines.Is my income from FiT taxable?

Yes, it is taxable. Any exemption will depend on future Government policies. MESTEXX is monitoring the progress of renewable energy growth in the country and conducting analyses before putting forth any policy recommendation on this matter.

I am a foreign investor. Can I apply for FiT approval, and what are the requirements?

Foreigners aged 21 and above can apply for FiT for renewable energy installation that utilises solar PV technology with a capacity of up to 72 kW. A company incorporated in Malaysia having foreigners, holding no more than 49% of voting power or the issued share capital of such company, may also apply.

Why is foreign equity capped at 49%?

It is stated in the National Renewable Energy Policy & Action Plan that the FiT System is to support local Malaysians.

Can a distribution licensee or utility participate in FiT?

Yes, but the equity shareholding is capped at a maximum rate of 49% if it is in its area of jurisdiction.

If you are off-grid in a rural area, can you apply for FiT?

Yes you can, but only if your community is serviced by a distribution licensee.

My company is located in an area where the distribution licensee is not TNB. Can I still get FiT?

It’s possible, but there are certain criteria you need to fulfill in order to qualify.

Who do I contact for further info on FiT?

Please contact SEDA Malaysia

-

AGED/ROUTINE METER REPLACEMENT PROGRAM

What is the Aged Meter Replacement?

It is a worldwide practice that replaces old meters that have exceeded its lifespan.

There are two meters with different lifespans:

- Electromechanical meter > 15

- Electronic meter > 10 years

Why do we replace meters?

- To ensure accuracy

- To ensure safety

Who owns the meter at my premises?

The meter is owned by TNB. However, you are responsible for making sure the meter is tampered with.

What type of meter will be installed at my premises?

Since 2004, all meters are electronic.

Will my bill increase after the new meter is installed?

The electronic meter is very accurate, so your charges will be according to the electricity you use. If you find that it is a little higher, then it could be because the aged meter was not accurate.

Why was the aged meter not accurate?

These are the possible reasons:

- Faulty

- Wear and tear, aging of the meter

- It was tampered with

Or it may not be that the meter is not accurate, but it may be due to:

- Increase in usage during festive seasons, school holidays, changes in weather, etc

- New tariff rates

- Arrears

- Power factor charges

- Renewal Energy Fund charges

Why does TNB replace meters that are still working?

According to the Electricity Supply Act 1990, aged meters must be replaced with new ones for accurate billing.

How does TNB know which meters should be replaced?

TNB has information on all meters and their ages.

Is there interruption of electricity supply while the meter is being replaced?

Yes, but only for about 15 minutes to 1 hour.

Which type of meter is more accurate – electromechanical or electronic?

Both are equally accurate.

Who will replace my meter?

It will be replaced by TNB appointed contractors, fully supervised by TNB staff. The contractors will carry a TNB/NIOSH ID, while TNB staff will be wearing TNB uniform and carry a TNB staff ID pass.

What are the working hours for TNB to replace my meter?

Normal working days (Monday – Friday) Weekends are by appointment only.

Will I get notification on Aged Meter Replacement?

Yes, you will receive written notice at least 48 hours before the replacement is carried out.

Can TNB enter my premises to change the meter?

Yes, according to the Electricity Act 1990, TNB can enter your property to replace the meter.

I received a notification that TNB was unable to enter my premises to replace my meter. What should I do?

Please contact the person in charge stated on the letter, to set an appointment.

Will consumption from an old meter and current new meter be billed in the next month?

Yes, both will be included in your next electricity bill, but charges will not be double.

Will I be billed for the electricity used to operate the meter?

No.

What are the benefits of replacing my meter?

- TNB will inspect the wiring and ensure it’s safe and in good working order

- TNB will replace any old or worn out wires

- Meters that are hard to access will be moved to a better spot for easier meter reading

- When your meter is shifted from inside the building to outside, you have more privacy as TNB staff will be able to read the meter without entering your property. Also, there will be no need for estimated bills

Do I have to pay for meter replacement and labour costs?

No.

How will I know that my new meter is accurate?

Every TNB meter is calibrated and tested in accordance to Malaysian Standards ISO/IEC 17025:2005. Furthermore, since 2013, all meters have gone through additional vigorous testing by SIRIM and awarded with a Product Certification.

What is the Energy Commission Metering Guideline?

It is a guideline for the approval, testing and initial verification of electricity meters before they are sent out and installed. This guideline is governed by the Energy Commission.

Is the new meter tested before installation?

All meters are calibrated and tested to Metering Guideline under the governance of the Energy Commission.

What is the calibration/accreditation standard used?

- All meters installed meet the Energy Commission Metering Guideline

- All meters are calibrated and accredited under Skim Akreditasi Makmal Malaysia (SAMM) based on MS ISO/IEC 17025:2005 issued by Standards Malaysia under purview of the Ministry of Science, Technology & Innovation (MOSTI)

- All meters are calibrated and comply to International Standards (MS IEC 62053-11, MS IEC 62053-21, MS IEC 62053-22, MS IEC 62053-23)

- All meters comply to International Standard OIML (e.g. Harmonics Test and Reliability Test)

How do I know that my meter complies to the Energy Commission Metering Guideline?

It will have a ‘SIRIM/ST’ sticker on it.

Is the Energy Commission involved with the aged meter replacement?

Yes, the Energy Commission monitors meter replacements through:

- Installation of check meter

- On-site meter testing based on customer complaints

- Joint on-site meter testing with TNB based on customer complaints

- Random on-site meter testing

Will my existing meter be tested on site before being replaced?

Yes.

How would I know if my meter has been replaced?

You will be notified after the meter replacement. Please contact TNB CareLine for details.

How do I calculate my appliances’ electricity consumption?

Kindly browse www.tnb.com.my and click Save Energy>Energy Audit Calculator>Start

-

myTNB PORTAL

I am a user of the myTNB App, do I have to re-register as a myTNB Portal user?

No. Just login with the same ID and password.

Where can I find the guideline on how to open an account, change of name, account closing and bill check ?

Please click below:

To check your bill, Register/Login to myTNB and click on Support > Bill & Payments

When I try to login, I get an error message informing me that my User ID or Password is incorrect. What should I do?

Please key in your myTNB User ID and Password correctly again. You have a maximum of 5 attempts. After 5 unsuccessful attempts, you will be redirected to Forgot Password page automatically to reset your password. Even though your myTNB Portal access has been blocked, you can still access your account(s) via myTNB App!

How would I know when a transaction has gone through?

The status of the transaction, whether ‘successful’ or ‘failed’, will be displayed. To verify the transaction, you can check the payment history of your account(s). We will provide you with a printable online proof of your transaction.

If I click the ‘back’ button, will the transaction/payment that I have submitted be deleted from the system?

Clicking the ‘back’ button at any stage will bring you back to the previous page. But if you have submitted a transaction and submission was confirmed, then it is accepted and not deleted.

If my payment transaction was unsuccessful, is the transaction record still in the system, or do I have to resubmit?

The payment transaction will be recorded in our system, whether successful or not. If unsuccessful, you will need to resubmit. Please resubmit only when you know why it failed. For example, if there’s insufficient funds, etc. Wait a few minutes, then try again. You can also call TNB CareLine at 1-300-88-5454 for assistance.

Why does my browser time out when I leave it idle?

This is to protect your account from unauthorised users when your device is left unattended. It has a built-in security feature that automatically times out after 30 minutes (for non-payment transactions)

I have forgotten myTNB Portal User ID. What should I do?

Email the name and mobile number you registered with us to tnbcareline@tnb.com.my and we will retrieve your myTNB Portal User ID for you.

I have forgotten myTNB Portal password. What shall I do?

You can reset your password by clicking on ‘Forgot Password’. You can continue using your existing myTNB Portal Login ID after resetting your password.

I didn’t receive OTP during password reset. What should I do?

Please call our TNB CareLine at 1-300-88-5454 to check if the mobile registered with us is the same one.

Can I keep the same User ID for myTNB Portal registration account if I already have one with my previous myTNB Portal registration?

No. You cannot use the same User ID. Please create a new one.

My activation email to complete myTNB Portal account registration process has expired. What should I do?

The activation email we send to you lasts only 24 hours. Once it has expired, you will need to repeat the process. But you can still use the same mobile number and email address to re-register. If you can’t activate your login account, please call TNB CareLine at 1-300-88-5454 for assistance.

What is OTP?

OTP stands for ‘One-Time-Password’. It is a randomly generated code sent to your registered mobile number or devices for validation of your online transaction. It is a security measure to ensure that nobody else can access your account.

What happens if I receive an OTP via SMS which I did not request for?

Please inform TNB CareLine at 1-300-88-5454 immediately.

Can I re-use an OTP?

No. Each OTP sent to you is valid for one time use only.

I keyed in my OTP as requested and got an error message. Why?

These may be the possible reasons:

- Your OTP is incorrect or has expired

- You have exceeded the maximum number of attempts

I requested for OTP twice. Which OTP should I use?

Use the second OTP sent to your phone.

How long does it take to receive my OTP via SMS?

It depends on the traffic volume of your mobile service provider.

Can I receive my OTP via SMS when I’m overseas?

Yes, as long as your phone is connected to mobile data.

If I don’t receive my OTP, what should I do?

Just click on the resend link to request a new OTP. The new OTP will be sent to your registered mobile number via SMS.

-

SMART METER

COVID-19

Are there any extra measures taken to reduce the risk of COVID-19 transmission during the meter installation?

We share your concerns and TNB does have procedures in place adhering to the guidelines provided by the Ministry of Health (MOH). All TNB staff are required to perform a health screening test prior to any site visit, observe the standard of social distancing and put on a face mask when they’re at a customer’s premise.

GENERAL

Will my supply be disconnected during the MCO?

There will be no disconnection of electricity supply till 31 March 2021 for residential customers with arrears not exceeding 6 months. If you have any further questions, you may contact TNB CareLine at 1300-88-5454, message us via Facebook or submit your enquiries through the myTNB app. to discuss the available options and seek advice on your consumption and billing.

I do not want an installation of Smart Meter now due to COVID-19, can I reschedule my installation to the end of the current MCO restrictions?

Yes, you can. We understand that safety is a priority for you as it is for us. If you wish to reschedule to a later date, you may do so by contacting us at TNB CareLine at 1300-88-5454. However, we strongly recommend for you to re-schedule your installation date soonest possible to ensure you do not miss the opportunity of having a smart meter, which would help you manage your usage during the MCO.

Is TNB still doing face-to-face engagements and events?

No. As your safety is our priority, there are no events organized during the MCO. However, small team engagements with your JMB/ RA/ Community representative will still continue to provide information on the upcoming Smart Meter rollout. Please look out for the notification letters in your mail box or updates from your JMB/ RA/ Community Representatives.

What are the criteria and precautions taken by TNB before conducting physical engagements?

Our current preferred mode of engagement is via online or virtual platforms. In the event physical engagements are required, strict SOPs are in place to ensure that our installers are in full compliance of all guidelines set by the Ministry of Health. This includes daily temperature checks, mask wearing, sanitisation, contact tracing and social distancing during engagement with JMB/ Residents.

I have other questions relating to Smart Meter installation after the TNB Smart Meter engagement, where can I get more information?

You may visit our smart meter portal at www.mytnb.com.my/smart-meter for more information. If you are a JMB/ RA/ Community representative, please contact the TNB representative that reached out to you for further clarification.

How do I recognise a TNB representative reaching out to me via phone call?

We may reach out to you via phone calls to share more about the benefits of smart meters and to seek feedback on your smart meter experience. If you have any concerns regarding the authenticity of our representatives, please feel free to contact us via TNB CareLine at 1300-88-5454. You may also request for our representative’s name, phone number and staff ID for verification purposes.

What if I am not at home during the Smart Meter installation?

If our installers arrive at your premises and find that you are not at home, they will leave a door hanger on your gate and you will have the option to re-schedule an appointment. For rescheduling purposes, you may contact us via TNB CareLine at 1300-88-5454. For missed appointments, do not worry as our installer team will return to your area as soon as we can.

Who do I reach out to if I face any issues relating to the installed Smart Meter?

For smart meter related questions, you may visit our Smart Meter web portal at www.mytnb.com.my/smart-meter. If you require further assistance, please reach out to us via TNB CareLine at 1300-88-5454.

How do I identify an authentic TNB letter to protect myself from fraud?

We have begun the Smart Meter installations in Melaka and Klang Valley. If you are staying within these areas, you will soon receive a notification with the installation details. To identify official TNB letters, you can verifying the following aspects:

- TNB Logo

- Reference number

- TNB account number

- TNB CareLine at 1300-88-5454 for verification

SMART METER COST / COST

Do consumers have to pay the electricity charge used by the "Smart Meter" to function?

No charges will be incurredto the customer. Customers are only charged based on their total current electricity consumption.

What can I do if I have issues managing my energy bills during the COVID-19 pandemic?

We know that this pandemic has significantly impacted all our customer’s lives, so be assured that we are here to help. If you require further support during this pandemic, we encourage you to reach out to us via TNB CareLine at 1300-88-5454

RADIO FREQUENCY (RF) / HEALTH

What are the measures TNB is taking to manage the spread of Covid-19?

TNB is committed to minimising the spread of COVID-19 by ensuring that:

- All staff complete the daily health reporting and monitoring through ESHD (Employee Self Health Declaration) alongside the mandatory MySejahtera check-in at TNB premises and other public premises

- All appointed meter installers strictly comply with the SOPs. For example, daily temperature checks, mask wearing, sanitization, contact tracing and social distancing with JMB / residents during visits / installations and swab tests

Will the COVID-19 pandemic affect the electricity supply to my home or business?

Good news! TNB has announced that there will be no disruption to your electricity supply up till 31 March 2021. Our “Pasukan Pembaikpulih Bekalan” (PPB) team is a response team to address electricity outages and is considered an essential service. In the event of an outage, please contact Careline at 15454 and our teams will be ready to serve you.

During the installation, the installers did not comply to the SOPs required by MoH.

We deeply regret and apologize for not adhering to the guidelines. Our installers are under strict instruction to abide by all SOPs by the MoH as well as additional precautions by TNB. If you have encountered such a situation, we would like to hear from you so that we can take quick action to avoid any reoccurance. Kindly contact us via Careline at 1300-88-5454 to share details of your experience.

What will happen if an installer who visited my premises was tested positive for COVID-19?

The installer would stop all installation works immediately while TNB performs contact tracing for all installations performed by the affected installer. Contact tracing information will be provided to the Ministry of Health for their further action.

ONBOARDING

Someone is due to visit my home or building to install a smart meter – What will happen?

You will receive a notification letter from TNB. Our installers will arrive at your premise and will be identifiable via their ID Cards & Uniform. They will do the necessary checks on your electricity box or riser room before they proceed with the installation.

What are the safety measures taken by the installers that visit my premises?

We are taking the necessary steps to ensure that our installers strictly comply with all guidelines set by the Ministry of Health, such as daily temperature checks, mask wearing, sanitisation, contact tracing and social distancing with JMB/ Residents during the installation.

SMART METER DEVICE

Is it necessary for me to change to Smart Meter?

In support of Malaysia’s Digital Transformation, it is of utmost importance for every household to change to Smart Meter. Therefore, the upgrade is necessary to align with the government’s initiative towards realising Industrial Revolution 4.0.

How does the Smart Meter work?

The Smart Meter records how much electricity you use and sends the data back into TNB’s back end system daily. You can then view your half hourly daily usage via myTNB App and myTNB Portal the following day. Monitoring your usage patterns allows you to be more energy efficient and better manage costs.

What can I see on my Smart Meter screen?

- Kilowatt-hour (kWh): The energy charge for the amount you pay for electricity usage/ the cost per unit of electricity.

- Kilowatt (kW): The total amount you pay based on your usage

How would I know if the Smart Meter readings are accurate?

The Smart Meters have been certified by the Energy Commission to ensure that they meet all international standards, including accuracy. All meters are calibrated and certified against the Metering Guideline under the purview of the Energy Commission.

Will I be charged to power the Smart Meter?

No, you will not. Smart Meter is safely powered from TNB’s electricity supply.

BENEFIT

How will the Smart Meter help me become more energy efficient and save money?

- Installing the Smart Meter makes it easier for you to identify how much energy you’re using via myTNB app. This allows you to decide on where and how to reduce your usage and subsequently, cost

- Smart Meter also means improved reliability in data, so you can be confident that you're only paying for what you have used

- For more information, find out more at: https://www.mytnb.com.my/smart-meter

INSTALLATION

What is the cost of a Smart Meter installation?

TNB’s Smart Meter and its installation is Free of Charge (FOC)

How do I verify if the installer coming to my area is from TNB?

TNB contractors can be recognised by their orange uniform labelled “Kontraktor TNB”. They will display their identification cards (ID) and present their ID to you upon request. You may also contact TNB Careline at 1300-88-5454 to verify identification of the contractors if needed.

Will my power supply be switched off when the meter is being replaced?

Yes. Your power will be switched off briefly (30 to 60 minutes) at the point of changing your meter.

What will happen if no one is at my home when the contractor comes to install the meter?

We will leave a door hanger at your gate and return another day. If you would like to schedule an appointment, kindly contact TNB Careline at 1300-88-5454.

What should I do if I encounter a problem with my Smart Meter?

Kindly contact us via TNB Careline at 1-300-88-5454. Issue assessment and meter replacement would be carried out if necessary.

SAFETY

Is the Smart Meter safe?

Yes! The Smart Meter have been certified by the Energy Commission under the Electricity Supply Act 1990 to ensure that it meets all international standards. It has also been approved by SIRIM & SKMM.

Is the Smart Meter network secure?

Yes, the Smart Meters and the networks adhere to Malaysia’s Personal Data Protection Act (PDPA). TNB also ensure the cyber security encryption, measures and features are implemented in the Smart Meter system and network. We are constantly assessing our network to improve the security controls and no systems can be compromised.

BILLING

How will I receive my bill after the Smart Meter is installed?

You will continue to receive your physical bill. Manual reading by our meter readers will be done until the meter is enabled for automatic billing within the first three months. At the same time, you can also view your monthly bill through myTNB App.

Will my electricity bill increase after installing a Smart Meter?

No, if your usage is consistent upon installation. Your electricity bill will be based on your total usage and tariff block. Higher block tariffs indicate a higher volume of increase in usage.

-

FUEL SUBSIDY BY THE FEDERAL GOVERNMENT

What is fuel subsidy stated in your electricity bill?

- Fuel subsidy is the amount of fuel cost subsidised by the Government for a unit of electricity consumed

- The amount stated in the electricity bill refers to the subsidy on piped gas price only

- The subsidy is based on benchmark market gas price set in base electricity tariff compared to the actual piped gas price used in the current electricity tariff charged to consumers

- The fuel subsidy amount indicated in the electricity bill is strictly for indication/information purposes only with NO monetary transaction

Why is the fuel subsidy calculated separately in the bill?

It is calculated separately in the bill to indicate the actual cost of electricity that you should pay for your electricity consumption in the absence of the Government’s fuel subsidy.

How is the subsidy calculated and based on what market price?

It’s calculated based on this formula:

- Gas cost per unit sales for every RM1/mmbtu x difference in benchmark market price of gas and the subsidised piped gas price used in current tariff x total electricity consumption for the month in kWh. The benchmark market price of gas is determined by the Government

How often is this subsidy calculation revised?

It is revised based on the revision of the regulated price of pipes gas every 6 months by the Government.

What is the current subsidy amount?

Effective 1st July 2018 until 31st December 2018:

- Residential : <300 kWh = RM 0.00 /kWh

- Residential : >300 kWh = RM 1.35 /kWh

- Business : RM 0.00 /kWh

-

METER REPLACEMENT (DUE TO IRREGULARITY)

What is meter irregularity?

Meter Irregularity is when the meter is not recording the electricity consumption correctly. This can be due to hardware, software or human error, which includes:

- Meter inaccuracy

- Malfunctioning of the meter or its installation or both

- Incorrect meter reading

- Cross-connection of different accounts

- Faulty installation

How does TNB calculate undercharged or overcharged amount for Meter irregularity cases?

The calculation is based on your consumption record and history, available technical evidence and other relevant information.

Do you have to pay for the cost of meter replacement due to irregularities?

No, of course not. TNB will bear the cost of meter replacements unless you are responsible for damaging the meter, or for neglecting it during a fire or flood.

What happens if there are irregularities or incorrect charges in my electricity bills?

Please make a report and we will make the adjustments. However, we can only go as far back as the previous 3 months’ bills. After calculating the irregularities, we will make the adjustment in your next bill.

How do I report a meter irregularity case?

You can report it through any of the following channels:

- Call TNB One Stop Enquiry Centre 1300-88-5454

- Email CareLine@myTNB.my

- Go to www.tnb.com.my and click Contact Us>Customer Care>Submit Feedback

- Go to www.tnb.com.my and click Follow Us >Chat With Us

- Visit Pusat Khidmat Pelanggan TNB

-

OWNER / TENANT ISSUES

Some home owners are left with huge bills when their tenants move out. How can you protect yourself if you’re a landlord?

There are two ways:

- Before a tenant moves in, you can do a Change of Tenancy, and make the tenant fully responsible for the account. However, this also means that you will lose the right to disconnect if the tenant defaults in his/her monthly electricity bills.

- Register with e-Services so you can monitor your tenant’s monthly usage and payments.

Who can I contact for details on this?

- Call TNB One Stop Engagement Centre 1300-88-5454

- Email CareLine@myTNB.my

- Go to www.tnb.com.my and click Contact Us > Customer Care > Submit Feedback

- Go to www.tnb.com.my and click Follow Us > Chat With Us Visit Pusat Khidmat Pelanggan TNB

-

POWER QUALITY

How is Power Quality measured?

It is generally measured by the shape of the voltage waveforms supplied at your meter. The voltage waveforms may reduce, increase, fluctuate or distort due to various circumstances.

What kind of equipment can be affected by Power Quality problems?

Any type of electrical equipment can be affected. Standard systems like lighting, air-conditions, fans, and communications equipment are often affected. The most costly power quality problems often happen to sensitive high-tech equipment such as computer controlled equipment and data systems.

How do I know if my business has Power Quality problems?

Go through this checklist:

- Do you have premature failures of electronic equipment, motors and drivers?

- Do your adjusted speed drivers often trip into offline mode?

- Does your computer tend to shut down for no apparent reason?

- Does your computer screen tend to jitter?

- Do you get equipment problems during or shortly after a lightning storm?

- Do your circuit breakers trip when they’re not even overloaded?

- Are your transformer cases extremely hot?

- Does your power factor capacitor bank fail prematurely?

- Do your equipment tend to malfunction at the same time every day?

- Do your automated systems fail for no apparent reason?

- Do certain equipment function in one location but not in another?

- Have you experienced lights dim or flicker, followed by the malfunctioning of equipment?

What causes Power Quality problems?

The most common causes are lightning strikes, equipment failures, third party intrusion, weather conditions, and operating on non-linear and fluctuating loads.

Are there National and/or International Standards that describe Issues on Power Quality?

Some of the international standards that explain the power quality phenomenon are:

- IEC 61000-2-1: Definition of Electromagnetic Compatibility (EMC) EMC is concerned with the possible degradation of the performance of electrical and electronic equipments due to the disturbances present in the electromagnetic environment, in which the equipment operates

- IEC 61000-2-4: Compatibility levels in industrial plants for low frequency conducted disturbance

- IEC 61000-2-12: Electromagnetic compatibility (EMC) - Part 2-12:Environment - Compatibility levels for low-frequency conducted disturbances and signalling in public medium-voltage power supply systems

- IEC 61000-3-6: Assessment of emission limits for distorting loads in MV and HV power systems.

- IEC 61000-3-7: Assessment of emission limits for fluctuating loads in MV and HV power systems.

- MS 1760:2004: Guide on voltage dips and short interruptions on Public Power Supply System. The original standard is the IEC/TR 161000-2-8

- IEC 61000-4-11: Immunity test for voltage dips, short interruptions and voltage variation for equipment less than 16 Amp

- IEC 61000-4-34: Immunity test for voltage dips, short interruptions and voltage variation for equipment more than 16 Amp

- Engineering Recommendation P28 : Planning limits for voltage fluctuations caused by industrial, commercial and residential equipment in the United Kingdom

- Engineering Recommendation G5/4 : Planning levels for harmonic voltage distortion & connection of non-linear equipment to Transmission and Distribution Systems in the United Kingdom

- SEMI F47: Specification for semiconductor processing equipment voltage sag immunity

- SEMI F49: Guide for semiconductor factory system voltage sag immunity

-

TARIFF & ICPT

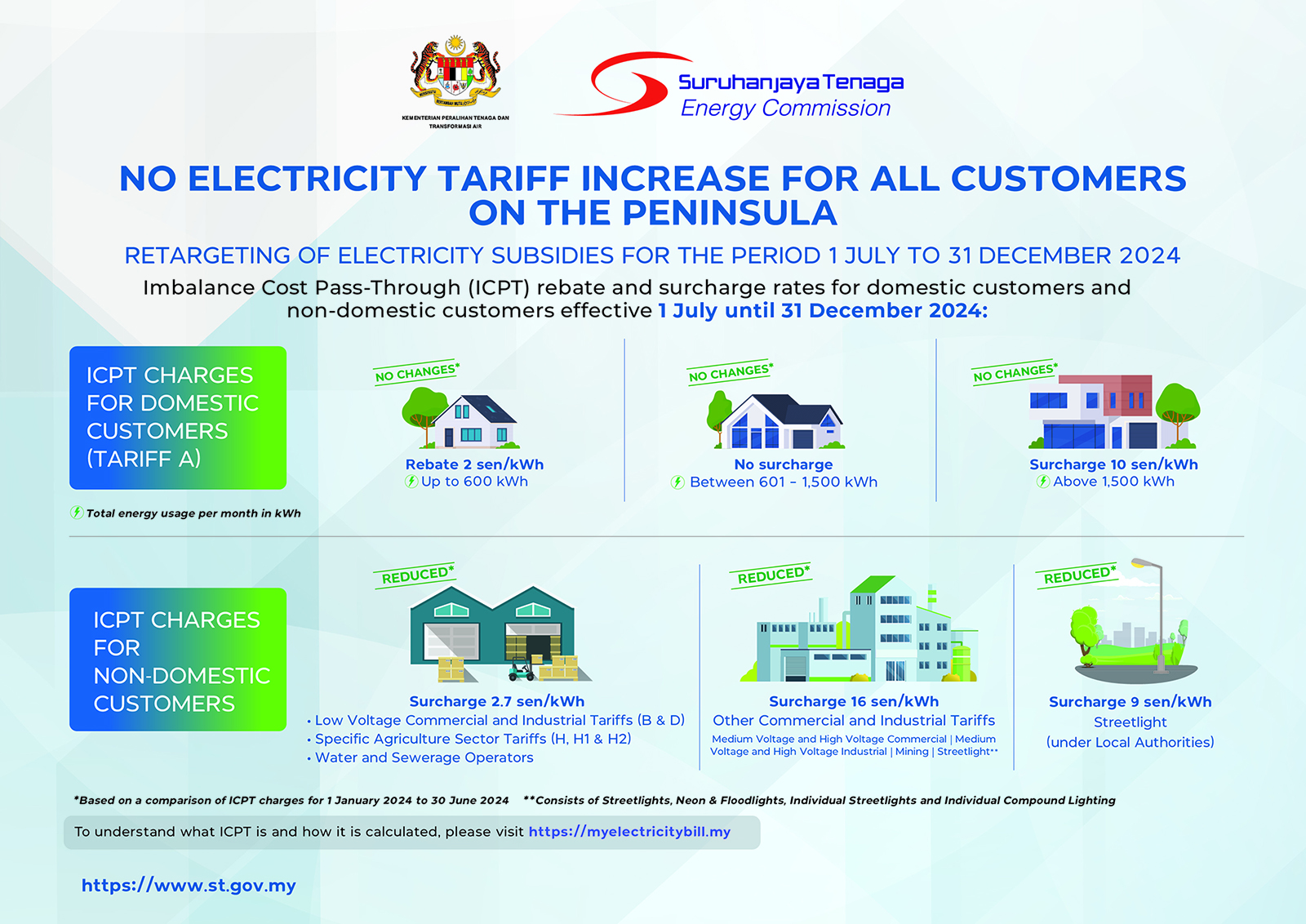

What are the ICPT quantum as announced by the Government on 23 June 2023 for the period of 1 July – 31 December 2024?

As announced by the Ministry of Energy Transition and Water Transformation (PETRA) on 29th June 2024, the Government has agreed to continue the implementation of the Imbalance Cost Pass-Through (ICPT) mechanism for the period of 1 July- 31 December 2024, the ICPT quantum for the period is as follows:

Domestic Customers (Tariff A):

Electricity consumption of 600 kWh and below Maintained ICPT Rebate of 2 sen/kWh Electricity consumption of between 601 kWh to 1,500 kWh Exempt from the ICPT Surcharge (Zerorised) Electricity consumption above 1,500 kWh Maintain ICPT surcharge of 10 sen/kWh

Non-Domestic Customers:

Note : For Water and Sewerage Operators, the 2.7 sen/kWh surcharge covers all tariffs excluding domestic accounts ,Tariff A.Low Voltage Commercial and Low Voltage Industrial (LV), Special Agricultural tariffs (Tariff H, H1 and H2), Identified Water and Sewerage Operators Reduce ICPT Surcharge to 2.7 sen/kWh (Previous ICPT surcharge was 3.7 sen/kWh)/kWh Other Commercial and Industrial tariffs such as Medium Voltage (MV) and High Voltage (HV) Commercial, Medium Voltage (MV) and High Voltage (HV) Industrial, Mining and Streetlight*

*Consists of Streetlights, Neon & Floodlights, Individual Streetlights and Individual Compound LightingReduce ICPT Surcharge to 16 sen/kWh (Previous ICPT surcharge was 17 sen/kWh) Streetlight (Under Local Authorities) Reduce ICPT Surcharge to 9 sen/kWh (Previous ICPT surcharge was 10 sen/kWh) Who will be affected by the ICPT rebate or surcharge from 1 July - 31 December 2024?

All categories of customers, either Domestic or Non-Domestic, will be impacted by the ICPT implementation, either in the form of a rebate or surcharge, as announced by Ministry of Energy Transition and Water Transformation (PETRA) on 29th June 2024.

The electricity tariff adjustment for the customers in Peninsular Malaysia from 1 July - 31 December 2024 are as follows:

What is Imbalance Cost Pass-Through (ICPT)?

ICPT is a mechanism under the Incentive Based Regulation (IBR) framework approved by the Government and implemented since 1 January 2014 which allows TNB, as the utility, to reflect changes in fuel and other generation-related costs in the electricity tariff. This is because these costs are set based on benchmarked prices in the base tariff. The implementation of ICPT, which occurs every six (6) months would reflect the actual costs in tariff in the form of either rebates or surcharges. Furthermore, the impact of the ICPT implementation is neutral on TNB and will not have any effect on its business operations and financial position.

What are the major factors contributing to the surcharge given in ICPT for the period of 1 July – 31 December 2024

Under the ICPT mechanism, fuel and generation costs will be reviewed every six (6) months and passed through to the customers in the form of rebates or surcharges depending on cost savings or cost increases within that stipulated period. In Peninsular Malaysia, more than 90% of the electricity generated uses coal and gas, and the cost of coal has increased significantly since October 2021. .

Due to this, the cost of fuel to generate electricity has been significantly higher than the approved prices determined for the Third Regulatory Period (RP3), which has led to an increase in generation costs resulting in an ICPT surcharge. This makes a huge impact on the electricity tariffs in Peninsula Malaysia because ~57% of the generation source is from coal./p>

The increase in coal prices is global and beyond the Government`s control. Moreover, not just in Malaysia but also globally, all electricity generation sectors are under pressure due to the increase in fuel costs.

Who is responsible for the ICPT calculation methodology?

The calculation and methodology of the ICPT mechanism are determined by the Energy Commission (Suruhanjaya Tenaga) and are subject to the Government’s approval on a 6-monthly basis

What are the components of the Imbalance Cost Pass-Through (ICPT) mechanism?

There are two key components in the ICPT mechanism:

- Fuel Cost Pass-Through (FCPT): The FCPT component captures any variation in fuel costs (specific to piped gas, liquefied natural gas (LNG) and coal) due to changes in the fuel price, fuel quantity, generation mix, exchange rate and etc.

- Generation-Specific Cost Pass-Through (GSCPT): The GSCPT component captures any variation in other generation-specific costs as a result of changes in other costs associated with the Power Purchase Agreements (PPAs) & Service Level Agreements (SLAs) as well as fuel procurement contracts i.e. Coal Supply Agreement (CSA), Coal Supply and Transportation Agreement (CSTA), Gas Supply Agreement (GSA) / Gas Framework Agreement (GFA) and etc.

How is the ICPT amount pass-through to customers being calculated?

The ICPT is calculated based on an estimated actual fuel cost and generation-related costs for a particular six-month period against the corresponding baseline costs in the Base Tariff.

Since 2015, Government has successfully implemented twenty (20) ICPT cycles and for the period 1 July – 31 December 2024, Government has allocated RM2,192 million in total on electricity subsidies.How is the ICPT amount pass-through calculated and what will be the impact to the bill?

ICPT is charged for each kWh of electricity consumed. The ICPT charge is a variable component of the electricity bill where the ICPT rate is based on your monthly electricity usage. ICPT is directly passed through, and its calculation is according to the monthly electricity consumption in kWh multiplied by the ICPT rate (sen/kWh). This ICPT charge will then be added or subtracted from your current bill amount.

How is ICPT calculated for solar consumers, such as Net Energy Metering (NEM)?

Customers with solar generation such as Net Energy Metering (NEM), Self-Consumption (SelCo) are also subjected to the ICPT implementation based on the categories listed above. The ICPT calculation will be based on import consumption (kWh) from the grid. Customers with solar generation, who do not have battery storage, are still consuming energy from the grid during non-solar generating hours, and hence, are affected by the ICPT adjustments.

Do all customers pay the same amount of ICPT charges?

No. The ICPT charge on your electricity bill may differ from your neighbours as the ICPT charges depend on your energy consumption (kWh) in a month. Therefore, this amount varies from one customer to another as well as from month to month, depending on the energy consumed.

Customers are advised to implement electricity saving measures as recommended by the Suruhanjaya Tenaga to optimise their energy consumption and cost.

What are the initiatives from the Government for customers to anticipate in the next ICPT rate?

The government has provided a user-friendly ICPT Calculation platform through https://myelectricitybill.my which customers may reach through the Suruhanjaya Tenaga’s official website (www.st.gov.my/en/web/press) for more information. The ICPT Calculator will help customers estimate the ICPT rate on their monthly electricity bills beginning from January 2024

The purpose of this ICPT Calculator is to educate customers to be more sensitive and alert to the changes in fuel prices and foreign exchange rates in the market. Customers can key in the coal and gas price forecasts as well as the fuel price and forex forecast to estimate the cost of ICPT at the next tariff adjustment

Apart from that, as a measure to reduce the cost of electricity bills, customers are encouraged to practise energy efficiency. Many simple ways can be done to save and reduce electricity consumption, which are:

- Conduct energy consumption audits by monitoring and analysing electricity consumption as well as identifying equipment, processes and systems that can be improved to avoid energy wastage;

- Identify and acquire electrical appliances that have 4 or 5-star ratings which provide more electrical energy savings. Among the electrical equipment are air conditioners, refrigerators, rice cookers, microwaves, televisions and washing machines;

- Ensure all switches are off when not in use to avoid wastage of electrical energy;

- To use the electrical appliances more efficiently, for example, setting the air conditioner temperature between 24°C and 26°C;

- Take advantage of the e-rebate of up to RM400 given by the Government through the SAVE 4.0 programme for the purchase of energy-efficient air conditioners and refrigerators with a 4 or 5-star rating and are recognised by the Energy Commission; and

- Apply for Net Energy Metering (NEM) programme, which has been extended until 2024 as announced by the Government as a measure to minimise the cost of customers’ electricity bills. Starting 1 April 2024, a new NEM Rakyat customer will receive rebate of 1,000/kwAC up to a maximum of RM4,000 under the new Solar for Rakyat Incentive Scheme (SolaRIS) program.

Is eKasih Program still continuing? How can customers eligible apply for eKasih?

The RM40 Electric Bill Rebate Programme is a targeted Government assistance initiative to finance monthly electricity bills of up to RM40 to those who are underprivileged and registered in the eKasih system.

The programme was announced by the Government in the 2019 Budget Speech on 2 November 2018, replacing the RM20 Electric Bill Rebate Programme, which ended in December 2018. In 2024, this programme is continued under the Miskin Tegar category of the eKasih system.

Eligibility for RM40 Electricity Bill Rebate Program can be verified at the Ministry of Natural Resources, Environment and Climate Change (NRECC) portal https://semakanrebat.nrecc.gov.my/apps/public/index.php or by contacting MyGCC hotline at 03-8000 8000 or TNB Careline 1-300-88-5454.

Eligible eKasih recipients that have an active TNB account (Tariff A, Domestic) will automatically receive RM40 rebate in monthly bills whereby for eligible eKasih recipients without TNB registered accounts, application may be submitted to declare third-party accounts by submitting the application form https://semakanrebat.nrecc.gov.my/apps/public/borang.php to the nearest Kedai Tenaga.

Click below to download the FAQ:

-

TNB ENHANCED TIME OF USE (ETOU)

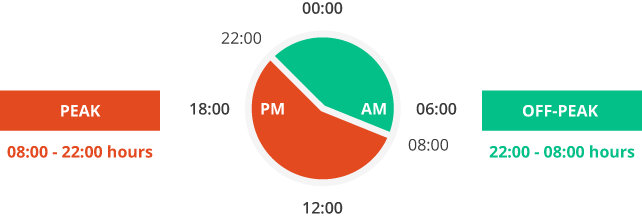

What is the TNB Time Of Use (TOU) tariff scheme?

TOU tariff scheme offers you different rates at different times of the day. For example, tariff rates during off-peak hours are lower than peak hours.

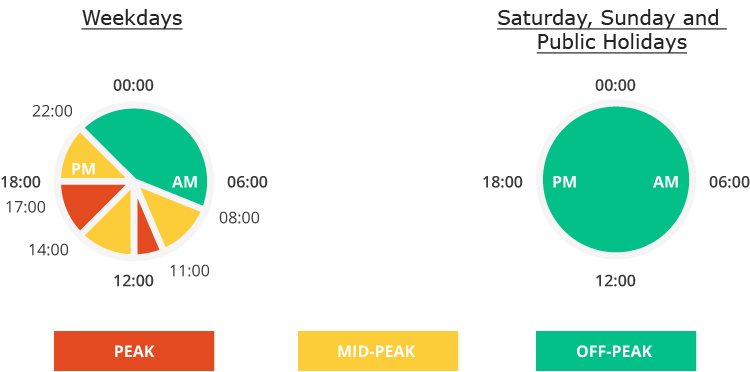

What is the TNB Enhanced Time Of Use (ETOU) tariff scheme?

ETOU tariff scheme offers you 3 time zones with different tariff rates – Peak, Mid-Peak and

Off-Peak rates for Monday - Friday.

Off-Peak rates apply to Saturday, Sunday & Public Holidays.

Maximum Demand charge has 2 time zones with Peak and Mid-Peak rates.

Monday to Friday 3 time zones with 3 energy rates for Energy charge: Peak, Mid-Peak and Off-Peak

2 time zones with 2 rates for Maximum Demand charge: Peak and Mid-PeakWeekends and Public Holiday 1 time zone with 1 energy rate : Off-Peak rate only

Maximum Demand Charge is waived during Saturday, Sunday, and Public HolidaysNote: ETOU will only include these fixed Public Holidays: New Year (1 January), Labour Day (1 May), Merdeka Day (31 August), Malaysia Day (16 September) & Christmas (25 December)

What are the differences between TOU and ETOU time zones?

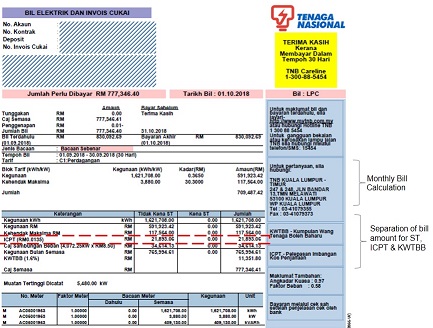

TOU Tariff

- TOU tariff has 2 time zones (Peak and Off-Peak)

TOU Time Zones are classified as follows:

ETOU Tariff

- ETOU tariff scheme has 3 time zones (Peak, Mid-Peak and Off-Peak) on Monday Friday

- Only 1 time zone (Off-Peak) applied on Saturday, Sunday and Public Holidays

ETOU time zones are classified as follows:

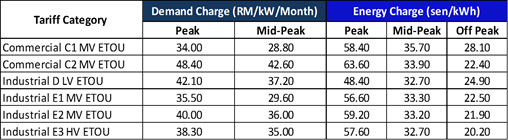

Enhanced Time of Use Time Zones Time Zone Hours Mid-Peak 08:00 - 11:00 hours Peak 11:00 - 12:00 hours Mid-Peak 12:00 - 14:00 hours Peak 14:00 - 17:00 hours Mid-Peak 17:00 - 22:00 hours Off-Peak 22:00 - 08:00 hours When will the ETOU tariff be offered to the customers?

The ETOU scheme will be offered as an option based on the schedule below:

Implementation of Enhanced Time of Use (ETOU) Schedule Date Tariff Categories Starting from 1 January 2016 Commercial customers at medium voltage (tariff C1 and C2)

Industrial customers at medium and high voltages (tariff E1, E1s, E2, E2s, E3 and E3s)Starting from 1 January 2017 Industrial customers at low voltage (tariff D and Ds) Note: However, low voltage Industrial customers may opt for the ETOU scheme starting from 1st January 2016, provided that they would upgrade to medium voltage tariff at their own cost.

Who are eligible for TOU and ETOU schemes?

TOU tariff scheme is offered to MV and HV customers under these categories:

- Commercial: Tariff C2.

- Industrial: Tariff E2,E2s, E3, E3s.

- Mining: Tariff F2.

ETOU tariff scheme will be offered as an option to LV, MV and HV customer under these categories:

- Commercial: Tariff C1, C2

- Industrial: Tariff D, Ds, E1, E1s, E2, E2s, E3 and E3s.

Why do the tariff rates vary at different times?

Electricity usage is different at different times of the day, that’s why electricity production cost will also change according to time of day. During peak hours there are more people consuming electricity, therefore, the cost of producing electricity is higher. Tariff rates are cheaper during off-peak or mid-peak hours due to lower demand.

Will ETOU replace the TOU tariff scheme?

No. The ETOU scheme is offered as an option.

Will the TOU customers be automatically switched to ETOU scheme?

No. TOU customers must apply to TNB for the ETOU tariff scheme.

Why does TNB offer ETOU?

ETOU gives you the opportunity to manage your consumption of electricity in a cost-effective way.

How does ETOU benefit me?

You can lower your electricity bills by taking advantage of the mid-peak and off-peak hours!

If I apply for ETOU, can I go back to my previous tariff scheme ?

You must commit to the ETOU scheme for at least 6 months. After that, you are free to cancel and go back to your previous tariff scheme, but you will be have to bear certain costs incurred.

Are there any special ETOU rates for the Special Industry Tariff (SIT) customer?

No. SIT customers are offered the same ETOU rates offered to non-SIT customers.

Can I be on SIT and ETOU scheme at the same time?

No. You have to subscribe to one or the other, but not both.

Is ETOU compulsory to all customers?

No. ETOU will be offered as an option for eligible customers.

Customers must choose the appropriate tariff scheme that best suits their energy consumption.

What is ETOU rate?

How to apply for ETOU scheme?

Customers who wish to enroll for ETOU scheme can submit formal application stating TNB Account to respective TNB Kedai Tenaga.

-

MAXIMUM DEMAND

What is Maximum Demand (MD)?

MD is measured in Kilowatt (kW). It is the highest level of electrical demand monitored in a particular period usually for a month period. Maximum Demand for any month shall be deemed to be twice the largest number of kilowatt-hours (kWh) supplied during any consecutive thirty minutes in that month.

Why does TNB charge MD?

During peak hours, when a great number of people are consuming electricity, TNB would need to be able to generate, transmit and distribute electricity sufficiently in order to meet the high demand, since electricity cannot be stored. MD charge was designed to encourage customers to control their electricity usage at peak hours, and maybe shift their usage to off-peak when the tariff rate is cheaper. MD charge is applied by almost all electric utility companies in the world.

Can TNB exclude customers from paying MD charges?

The MD charge is a very good way to encourage customers to use electricity more efficiently. It is a charge imposed on large customers that consume a huge amount of electricity. But domestic consumer that use low amounts are excluded from paying MD charges.

How can I reduce MD charges?

Here are some ways for you to reduce MD charges:

- Shift your electricity consumption to off-peak hours when there is no MD charges

- Look for TNB promos related to MD, like Sunday Tariff Rider Scheme (STR)

- Start your motor or heavy equipment in stages (not all together), or during off-peak hours

-

POWER FACTOR

What is Power Factor?

Power Factor is a method to gauge the efficiency of electricity usage. It is measured from 0 to 1. A higher number means more efficient. Low power factor shortens the lifespan of electrical appliances and causes power system losses to TNB.

KW Working Power (also called Actual Power, Active Power or Real Power). It is the power that powers equipment and performs useful work. KVAR Reactive Power. It is the power which magnetic equipment such as transformers, motors and relays need to produce the magnetizing flux. KVA Apparent Power. It is the vectorial summation of KVAR and KW.

Let’s look at a simple analogy in order to better understand these terms. Let’s say you are at a park and it is a hot day. You order a glass of a carbonated drink. The thirst-quenching portion of the drink is represented by KW. Unfortunately, along with your drink comes a little bit of foam. The foam does not quench your thirst. This foam is represented by KVAR. The total content of your glass, KVA, is this summation of KW (the carbonated drink) and KVAR (the foam).

Power Factor is the ratio of Working Power to Apparent Power. Power Factor = KW / KVA

Looking at our carbonated drink analogy, power factor is the ratio of carbonated drink (KW) to the carbonated drink plus foam (KVA). Power Factor = KW / (KW + KVAR) = Carbonated drink / (Carbonated drink + foam)

Thus, for a given KVA:-

i. The more foam you have, the lower your power factor.

ii. The less foam you have, the higher your power factor.

For efficient usage of electricity, power factor must approach 1.0. A Power factor that is less than 0.85 shows inefficient use of electricity.

What are the causes of low Power Factor?

Low Power Factor is caused by inductive loads which causes the current to lag. Examples are:

- Transformers

- Induction motors

- High Intensity Discharge (HID) lighting

Induction loads make up a very high percent of power consumed by the commercial and industrial sectors.

What can you do to improve your power factor?

Try these methods:

- Install capacitors (KVAR Generators)

- Capacitor

- Corrector

- Synchronous generators

- Synchronous motors

- Minimise idling or lightly loaded motors.

- Avoid operating equipment above its rated voltage.

- Use energy efficient motors.

How does improving the Power Factor benefit you?

Benefit 1: Reduce cost.

LA facility’s low power factor forces TNB to increase its generation and transmission capacity in order to handle the extra demand. When you increase your power factor, you will use less energy, which means lower cost.

Benefit 2: Eliminate power factor surcharge.

Utility companies around the world charge customers a surcharge when their power factor is low (less than 0.95). Some utility companies will not even supply electricity to customers whose power factor is below 0.85. In Malaysia, TNB is allowed to impose a surcharge to customers whose power factor is below 0.85. You can avoid this surcharge by increasing your power factor!

Benefit 3: Increased efficiency.

Low power factor causes power system losses in your electrical system. When you improve your power factor, you reduce these losses. What’s more, reducing system losses also means you can have additional loads and be overall more productive.

Benefit 4: Increased voltage level in your electrical system.

This means more efficient motors. As power losses increase, you will experience a voltage drop. Excessive voltage drops can cause overheating and premature failure of motors and other inductive equipment. So, by increasing your power factor you can minimise these voltage drops and also prevent problems. Your motors will run efficiently with a slight increase in capacity and starting torque. Listen to them purr happily.

-

SALES & SERVICE TAX (SST)

1. What are the tax charges that is applicable for electricity services?

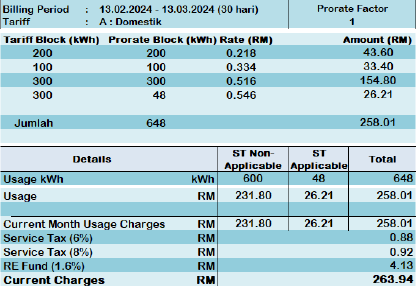

Under the Service Tax Act 2018, provision of electricity is prescribed as a taxable service under the Service Tax. However, not all TNB customers are subject to Service Tax. Service Tax is only applicable to residential customers (Tariff A - Domestic) subject to the following conditions:

- Total electricity consumption which exceeds 600 kWh; and the billing period is 28 days or more; OR

- If the billing period is less than 28 days, Service Tax will be imposed on your entire electricity consumption

Note: TNB customers residing in Pulau Tioman, Pulau Langkawi and Pulau Pangkor are not subject to Service Tax.

2. What is the applicable Service Tax rate for electricity services?

The Service Tax rate was initially set at 6% as of 1 September 2018 and is increased to 8% starting from 1 March 2024 according to Service Tax (Rate of Tax) (Amendment) Order 2024.

The applicable Service Tax rate is 8% subject to the conditions mentioned in Q1.

3. Where can I find information about the list of taxable services, including electricity services?

Information regarding taxable services, individuals and the total value of taxable services can be found in the First Schedule [Regulation 3] under the Service Tax Regulation 2018.

4. Which TNB Customer Categories are applicable to Service Tax?

Customer Category Service Tax Applicable Domestic (Residential) Yes based on condition defined in item 5 Commercial No Industry No Mining No Street Light No Agriculture No For more information regarding customer categories, please visit:

- Residential: https://www.tnb.com.my/residential/pricing-tariffs/ or

- Non-Residential: https://www.tnb.com.my/commercial-industrial/pricing-tariffs1/

5. Why is my billing period less than 28 days?

Generally, the monthly billing cycle is set from 28 to 31 days. However, the billing period can be less than 28 days in the following scenarios

- When customers request to terminate their supply contract with TNB.

- When customers sign a new supply contract with TNB.

- When customers request a change of tariff from Residential to Non-Residential or vice-versa.

- When consumers request a bill before the following billing cycle, the billing term is shorter than one month

6. Does TNB charge Service Tax on non-Residential customers?

No, non-Residential customers are not governed under the Service Tax Act 2018.

7. Will my electricity bill show how much Service Tax I have to pay?

Yes, but this applies only to residential customers (Tariff A - Domestic). You will find a separate line item clearly showing the Service Tax imposed. For the most up-to-date bill layout, please visit to https://www.tnb.com.my/residential/billing.

8. Which billing components are subject to the Service Tax?

- Energy Consumption (kWh)

- Discounts (Service Tax will be calculated after discounts)

- Imbalance Cost Pass-Through (ICPT)

- Temporary Load Charge

9. What other TNB services are subject to Service Tax?

Service Tax is applicable only to billing components specified in Question 8.

10. I have an Individual Streetlight attached to my account. Is Service Tax charged on Individual Streetlight consumption?

No. Individual street light is not subject to Service Tax.

11. TNB charges 1% interest on late payments. Is this subject to Service Tax?