UNDERSTANDING YOUR ELECTRICITY BILL

The electric bill - it comes once a month. Most of us glance at the balance due, and make plans to pay that amount. But the electric bill is more than just the amount owed. The bill is full of information that can be useful in helping you better understand your electric usage

Please note the information here is applicable for before 1 July 2025.

You may refer www.myTNB.com.my/tariff for information on the Electricity Tariff Restructuring, effective 1 July 2025.

HOW TO READ YOUR ELECTRICITY BILL

Your electricity bill contains a lot of information. This page will help you understand the most important billing components in your electricity bill.

-

Consumption Charges (kWh) / Caj Kegunaan

Customer electricity consumption will be charge as their usage. For residential customers, their usage are usually charged based on five block price rate.

The rates are as stated in Pricing & Tariff.

The unit for the consumption used is kWh.

Note: If billing period is above 31 days, proration factor applies

Example:

Customer A has a consumption of 350 kWh in his July 2018 bill. Based on price rate stated in Tariff book, the consumption will be divided into blocks as below

Consumption block Usage (kWh) Rate (RM/kWh) 200 200 0.218 100 100 0.334 300 50 0.516 Total consumption rate=(200 x 0.218) + (100 x 0.334) + (50 x 0.516)=RM102.80 -

Individual Street Light (ISL) / Lampu Jalan Individu

This information is valid until 30 June 2025. In line with the Electricity Tariff Restructuring effective from 1 July 2025, please visit https://www.mytnb.com.my/tariff for the latest updates

Domestic Customer that requires street light for their own consumption.

The charges applicable for street lighting are as below:

Wattage Rate 70 W RM 0.274/kWh/day 150 W RM 0.183/kWh/day 100 W RM 0.274/kWh/day ISL consumption is derived from below formula:

kWhISL=Total number of bulbs x Total Number of billing days x 12 x (Wattage/1000)ISL (RM)=kWhISL x Rate

Example 1: Customer with billing period below 31 days

Customer has installed ISL with the below installation properties

Two 150 W bulbs

Total Number of billing days = 25 days

Unit kWh ISL=2 x 25 days x 12 hours x (150 W/1000)=90 kWhISL RM=90 kWh x RM 0.183/kWh=RM 16.47Example 2: Customer with billing period above 31 days

Customer has installed ISL with the below installation properties

Two 150 W bulbs

Total Number of billing days = 33 days

Unit kWh ISL=2 x 33 days x 12 hours x (150 W/1000)=119 kWhISL RM=119 kWh x RM 0.183/kWh/day=RM 21.74 -

Temporary Load Charges / Bekalan Sementara

This information is valid until 30 June 2025. In line with the Electricity Tariff Restructuring effective from 1 July 2025, please visit https://www.mytnb.com.my/tariff for the latest updates

A consumer who applies for temporary supply shall be charged at the tariff rate appropriate to their category plus 33% surcharge on the current monthly bill. This is mostly applicable for construction site that requires temporary supply for their workers home.

Example:

A construction site applies for temporary supply for the workers house. The January 2018 bill will have the following billing components charges

Consumption charges (kWh) = RM55.20

ISL charges (RM) = RM12.00

ICPT* = RM1.30

Temporary Load Charge=(Consumption Charges + ISL Charges + ICPT) x Temporary Load Charge Rate=(55.20 + 12.00 + 1.30) x 33%=RM 22.61*Rate may varies every 6 months

-

Minimum Monthly Charges / Caj Minima Bulanan

This information is valid until 30 June 2025. In line with the Electricity Tariff Restructuring effective from 1 July 2025, please visit https://www.mytnb.com.my/tariff for the latest updates

Monthly charge applicable to a consumer in the event of monthly total electricity bill (kWh) is less than RM3.00. If consumption is 0 kWh, the RM3.00 is imposed in the bill.

The formula used to determine Monthly Minimum Charges are as following:

TMCC charges – (kWh charges + Discount Amount + ICPT)For more details, please refer to Pricing & Tariff

Example 1 : Customer with consumption = 0 kWh and billing period of 31 days

Customer A’s Jan 2018 bill shows usage of 0 kWh:

Consumption charges (kWh) = RM0.00

Discount TNB (10%) = RM0.00

Minimum monthly charges=RM 3.00 – RM (0 + 0.00 – 0.00)=RM 3.00Example 2: : Customer with consumption = 7 kWh and billing period of 32 days

Customer A’s Jan 2018 bill shows usage of 7 kWh:

Consumption charges (kWh) : 7 kWh x RM 0.218 = RM 1.53

Discount TNB (10%) = RM 0.15

Proration Factor (32/30 days) = 1.06667

Minimum monthly charges should be applied=1.06667 x RM3.00=RM3.20Since the consumption charges=RM 1.53The Monthly Minimum Charges=RM 3.20 – RM 1.53 - RM 0.15=RM 1.52 -

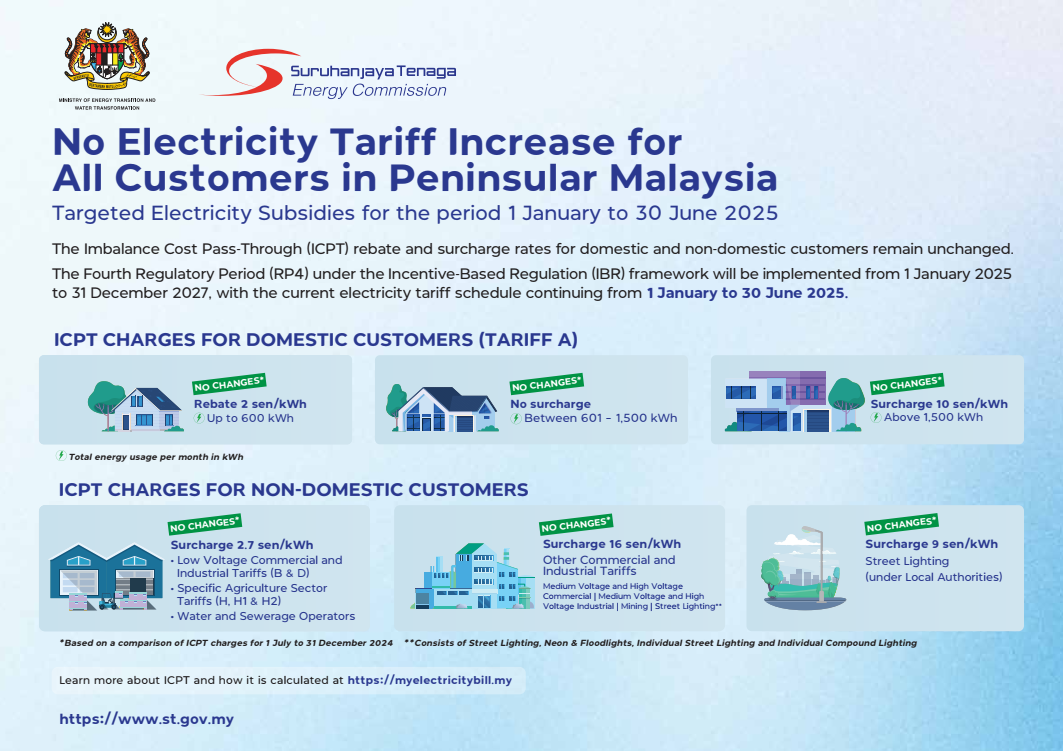

Imbalance Cost Pass Through (ICPT)

This information is valid until 30 June 2025. In line with the Electricity Tariff Restructuring effective from 1 July 2025, please visit https://www.mytnb.com.my/tariff for the latest updates

Imbalance Cost Pass Through (ICPT) is a mechanism under the Incentive Based Regulation (IBR) framework which allows for TNB, as the utility, to reflect changes in fuel and other generation-related costs in the electricity tariff. This is because these costs are set based on benchmarked prices in the base tariff.

The implementation of ICPT, which occurs every 6 months, would reflect the actual costs in tariff in the form of rebate or surcharge. Furthermore, the impact of ICPT implementation is neutral on TNB and will not have any effect on its business operations and financial position.

As announced by the Ministry of Energy Transition and Water Transformation (PETRA) on 20th December 2024, the Government has agreed to continue the implementation of the Imbalance Cost Pass-Through (ICPT) mechanism for the period of 1 January – 30 June 2025, and the ICPT quantum for the period is as follows:

Imbalance Cost Pass Through (ICPT) formula = Total kWh Consumption x ICPT Rate (RM/kWh).

Example 1: ICPT Calculation for Low Voltage Commercial, Tariff B

Consumption in April 2024 is 4,350kWh, ICPT rate is RM0.037/kWh

ICPT charge

=4,350kWh x (0.037)

=RM 160.95

Example 2: ICPT Calculation for Medium Voltage Industrial, Tariff E1

Consumption in April 2024 is 424,681kWh, ICPT rate is RM0.17/kWh

ICPT charge

=424,681 kWh x (0.17)

=RM 72,195.77

• To understand how it is calculated please visit MyElectricityBill

• For more information on what is ICPT, please visit our FAQ page. [English | Bahasa Melayu]

-

Service Tax (ST)

Under the Service Tax Act 2018, the provision of electricity is prescribed as a taxable service subject to 6% Service Tax. As a registered taxable entity, TNB is compliant to charge Service Tax for the provision of electricity.

First Schedule (Regulation 3) of the Service Tax Regulation 2018 explicitly outlines the supply of electricity to any Residential Customer (Tariff A – Domestic). This exclusion applies to the first 600 kWh for a minimum period of 28 days per billing cycle consumed by the customer, effective from 1 September 2018.

The 28-day billing rule applies, wherein the entire consumption will be charged Service Tax if the billing period is less than 28 days.

The Service Tax amount will be explicitly indicated in the electricity bill issued to the customer for items subject to ST.

The billing components related to consumption (kWh) is subjected to Service Tax are:

Energy Consumption (kWh)

Discounts (Service Tax will be calculated after discount)

Imbalance Cost Pass Through (ICPT)

Temporary Load Charge

Following the announcement by the Prime Minister during the Budget 2024 on 13 October 2024, the Service tax rate will increase from 6% to 8%, starting 1 March 2024. excluding services related to food and beverages and telecommunications. The new Service Tax rate has been gazette under Service Tax (Rate of Tax) (Amendment) Order 2024.

Starting from 1st March 2024, Residential customers with consumption exceeding 600 kWh or RM 231.80 and a billing period is 28 days or more will be subject to a Service Tax (ST) rate of 8% on their TNB electricity bills.

The Service Tax on the electricity bill for the months of February and March 2024 will be calculated proportionally, taking into account the number of billing days with both the previous Service Tax rate of 6% and the new rate of 8%.

As a taxable entity, TNB is obligated to apply the Service Tax as stipulated in the Service Tax Act 2018. The collected tax received will then be remitted to the Royal Malaysian Customs Department. For more information about Service Tax, you can visit the Royal Malaysian Customs Department website at mysst.customs.gov.my

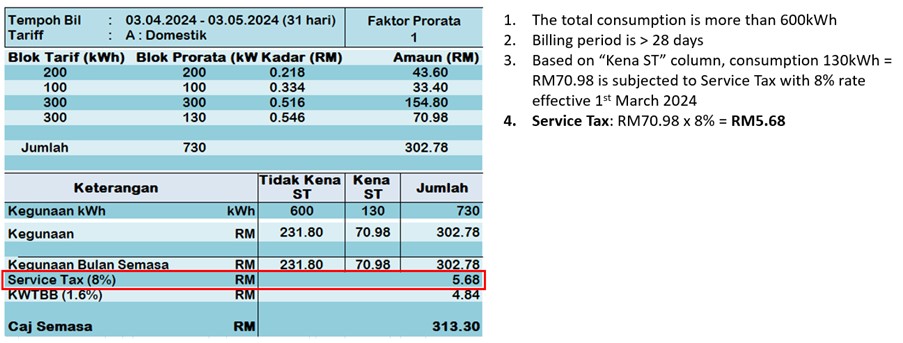

Example 1: Customer with consumption > 600 kWh @ above RM 231.80 where billing period is 31 days (above 28 days)

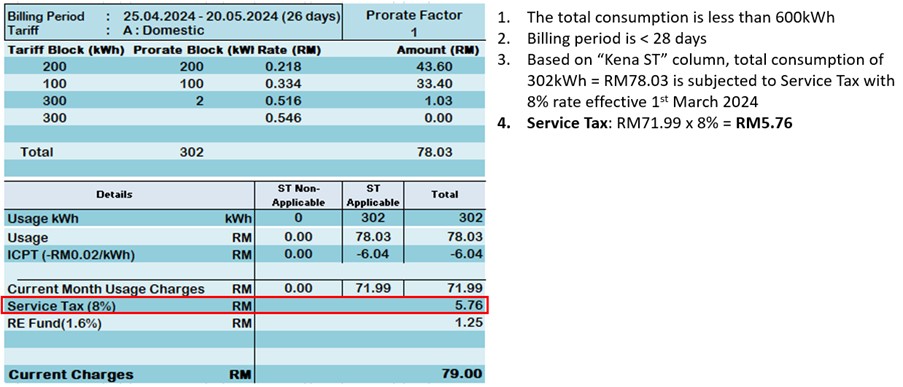

Example 2: Customer with consumption < 600 kWh but billing period is 26 days (below 28 days)

-

Kumpulan Wang Tenaga Boleh Baharu (KWTBB) / RE Fund

RE Fund (KWTBB) is a fund collected by the Government through consumer’s electricity consumption. The Fund will be used to promote growth of electricity generation from renewable energy resources.

In line with the Renewable Energy Act 2011 (RE Act 2011), the Renewable Energy (RE) fund (KWTBB) is collected through a surcharge of consumers’ electricity consumption at the rate of 1.6%.

TNB is only the collecting agent of the fund for the Government.

Surcharge of RE Fund (KWTBB) applies to all customers except for domestic customers with electricity consumption of 300 kWh @ RM 77.00 and below per month.

RE Fund (KWTBB) surcharge is calculated as follows: RE Fund (KWTBB) Surcharge = 1.6% × [(kWh+kW) – Discounts]

The RE Fund (KWTBB) collected from the customer’s electricity bill is channelled to the Government (SEDA - Sustainable Energy Development Authority). For more information, you can visit this website: seda.gov.my

Example:

Customer A uses consumption of 400 kWh and has an Individual Street Light (ISL) attach to his account.

The KWTBB charges on his bill will show as below:Consumption charges = RM87.20 for 400 kWh

ISL Charges = RM12.00

10 % TNB Discount = RM 8.72

RE Fund (KWTBB) Surcharge=1.6% x [(87.20+12.00) – 8.72)]=RM 1.45 -

1% Late Payment Surcharge

When it is imposed

The penalty charge will be imposed if payment is made later than 30 days after the bill dateHow it is calculated

The amount is calculated based on 1% (simple interest) of the outstanding bill amount, multiplied by number of days outstanding.Waivers

This penalty cannot be waived unless proven to be an administrative error on TNB’s part.How to Avoid it

Please pay your bill within 30 days from the bill date.Example:

Total billed amount: RM1,000.00

Bill date: 1 May 2018

Date of payment: 10 June 2018

Days outstanding: 10 days

So, the penalty charge=RM1,000 x 1% x (10/30)=RM 3.33 -

Prorate Factor

Proration factor applied by TNB will benefit the customers whose meter is read above 31 days.

Any billing period above 31 days will be prorated.

Proration Factor = Number of billing days / 30

Prorated Factor will be multiplied with each tariff block. Customer will benefit lower rate for expanded consumption block range.

Example:

Customer A receives Jan 2018 bill with 32 days billing period with consumption 400 kWh

Proration Factor=32/30=1.06667Consumption

block (default)Usage (kWh) - Prorated Rate (RM/kWh) 200 200 x 1.06667 = 213 0.218 100 100 x 1.06667 = 107 0.334 300 400 – 213 – 107 = 80 0.516 Total Consumption Rate=(213 x 0.218) + (107 x 0.334) + (80 x 0.516)=RM 123.45