UNDERSTANDING YOUR ELECTRICITY BILL

Please note the information here is applicable for before 1 July 2025.

You may refer www.myTNB.com.my/tariff for information on the Electricity Tariff Restructuring, effective 1 July 2025.

HOW TO READ YOUR ELECTRICITY BILL

-

Consumption Charges (kWh) / Caj Kegunaan

Customer electricity consumption will be charge as their usage. The rates are as stated in Pricing & Tariff. The unit for the consumption used is kWh.

For low voltage customer (commercial, industrial and agriculture), their usages are usually charged based on two block price rate which are ≤ 200 kWh and above 200 kWh.

For medium and high voltage customer, only one price rate is applicable as stated in Pricing & Tariff.

Note: If billing period is above 35 days , proration factor applies

Example 1:

Low Voltage commercial customer A has a consumption of 350 kWh in his July 2018 bill. Based on price rate stated in Tariff book, the consumption will be divided into two blocks as below

200 kWh x RM 0.4350 = RM 87.00

150 kWh x RM 0.5090 = RM 76.35Total Consumption Rate=RM87.00 + RM76.35=RM 163.35Example 2:

Medium Voltage Commercial customer B has consumption of 500 kWh in his July 2018 bill

Total Consumption Rate=500 kWh x RM 0.3650=RM182.50 -

Maximum Demand (kW) / Kehendak Maksima

MD is measured in Kilowatt (kW). MD is the highest level of electricity demand recorded by TNB meter during a 30-minute interval in a month.

The kW amount charged to customer is based on

Recorded MD (kW) x *MD rate

*Please refer the rates in Pricing & Tariff.

For more information, refer to Maximum Demand FAQ.

Example:

The amount payable by a Tariff C2 customer registering 100kW of MD for a particular month

kW Charges=100kW x RM45.10/kW=RM 4,510Few activities could be carried out by customers that assist in reducing MD charges such as:

Practicing demand side management such as peak shift i.e. shifting their peak operation/consumption to off peak period as MD charges is not applicable during off-peak period for customer with peak/off-peak tariff

Opting for any promotional scheme offered by TNB relating to MD such as Sunday Tariff Rider Scheme (STR).

Starts your motor/equipment in stages or during off-peak period

-

Temporary Load Charges / Bekalan Sementara

This information is valid until 30 June 2025. In line with the Electricity Tariff Restructuring effective from 1 July 2025, please visit https://www.mytnb.com.my/tariff for the latest updates

A consumer who applies for temporary supply shall be charged at the tariff rate appropriate to their category plus 33% surcharge on the total monthly bill. This is mostly applicable for construction site that requires temporary supply for construction site/site office.

Example:

A construction site applies for temporary supply for the site office. The January 2018 bill shows the following billing components charges

Consumption charges (kWh) = RM55.20

ICPT = RM1.30

Temporary Load Charge=(Consumption Charges + ICPT) x Temporary Load Charge Rate=(55.20 + 1.30) x 33%=RM 18.65*Rate may varies every 6 months

-

Minimum Monthly Charges / Caj Minima Bulanan

This information is valid until 30 June 2025. In line with the Electricity Tariff Restructuring effective from 1 July 2025, please visit https://www.mytnb.com.my/tariff for the latest updates

For low voltage customer (commercial, industrial and agriculture, monthly charge applicable to a consumer in the event of monthly total electricity bill (kW and or kWh) is less than RM7.20. If consumption is 0 kWh, the RM7.20 is imposed in the bill.

For medium and high voltage customer, monthly charge applicable to a consumer in the event of monthly total electricity bill (kW and or kWh) is less than RM 600.00. If consumption is 0 kWh, the RM 600.00 is imposed in the bill.

The formula used to determine Monthly Minimum Charges are as following:

TMMC charges – (kWh charges + kW charges + Discount Amount + ICPT)Example 1:

Medium voltage Customer with billing period below 31 days receives Jan 2018 bill with the following charges

Consumption charges (kWh) = RM5.00

Maximum Demand charges (kWh) = RM45.00

ICPT = RM0.50

Minimum monthly charges=RM600 – RM (5.00 + 45.00 – 0.50)=RM550.50Example 2:

Low voltage customer with billing period 38 days receives Jan 2018 bill with the following charges

Consumption charges (kWh) = RM0.00

ICPT kWh = RM0.00

Proration Factor (38/30 days) = 1.26667

Minimum monthly charges=1.26667 x RM7.20=RM9.12 -

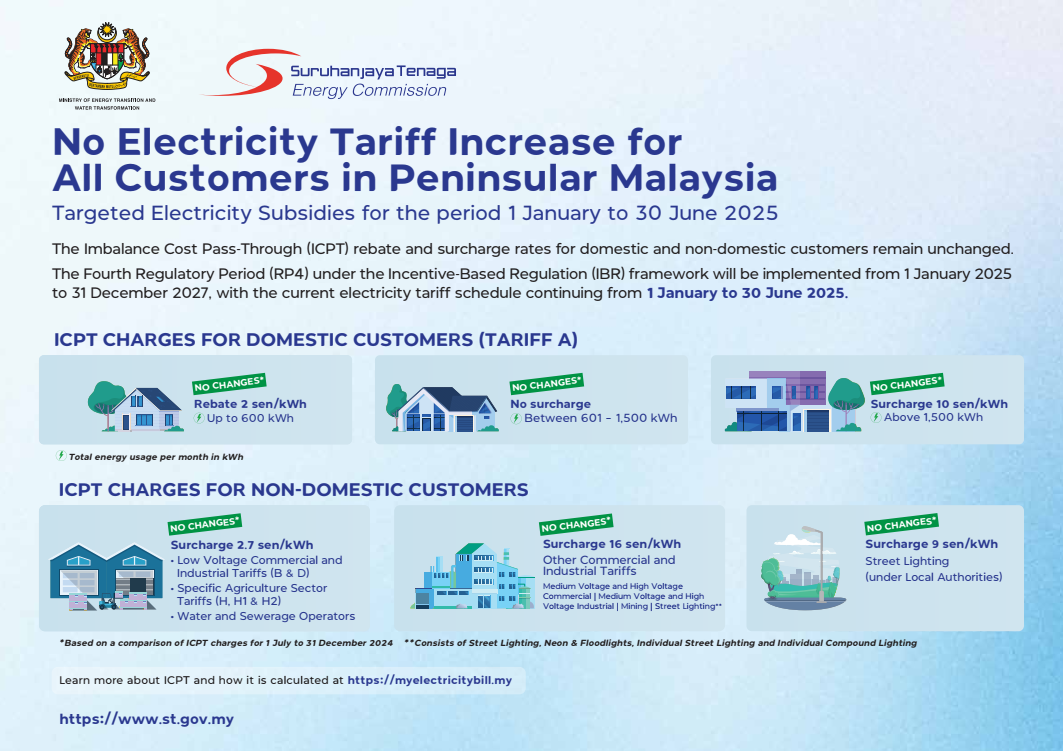

Imbalance Cost Pass Through (ICPT)

This information is valid until 30 June 2025. In line with the Electricity Tariff Restructuring effective from 1 July 2025, please visit https://www.mytnb.com.my/tariff for the latest updates

Imbalance Cost Pass Through (ICPT) is a mechanism under the Incentive Based Regulation (IBR) framework which allows for TNB, as the utility, to reflect changes in fuel and other generation-related costs in the electricity tariff. This is because these costs are set based on benchmarked prices in the base tariff.

The implementation of ICPT, which occurs every 6 months, would reflect the actual costs in tariff in the form of rebate or surcharge. Furthermore, the impact of ICPT implementation is neutral on TNB and will not have any effect on its business operations and financial position.

As announced by the Ministry of Energy Transition and Water Transformation (PETRA) on 20th December 2024, the Government has agreed to continue the implementation of the Imbalance Cost Pass-Through (ICPT) mechanism for the period of 1 January – 30 June 2025, and the ICPT quantum for the period is as follows:

Imbalance Cost Pass Through (ICPT) formula = Total kWh Consumption x ICPT Rate (RM/kWh).

Example 1: ICPT Calculation for Low Voltage Commercial, Tariff B

Consumption in April 2024 is 4,350kWh, ICPT rate is RM0.037/kWh

ICPT charge

=4,350kWh x (0.037)

=RM 160.95

Example 2: ICPT Calculation for Medium Voltage Industrial, Tariff E1

Consumption in April 2024 is 424,681kWh, ICPT rate is RM0.17/kWh

ICPT charge

=424,681 kWh x (0.17)

=RM 72,195.77

• To understand how it is calculated please visit MyElectricityBill

• For more information on what is ICPT, please visit our FAQ page. [English | Bahasa Melayu]

-

Kumpulan Wang Tenaga Boleh Baharu (KWTBB) / RE Fund

RE Fund (KWTBB) is a fund collected by the Government through consumer’s electricity consumption. The Fund will be used to promote growth of electricity generation from renewable energy resources.

In line with the Renewable Energy Act 2011 (RE Act 2011), the Renewable Energy (RE) fund (KWTBB) is collected through a surcharge of consumers’ electricity consumption at the rate of 1.6%.

TNB is only the collecting agent of the fund for the Government.

RE Fund (KWTBB) surcharge is calculated as follows: RE Fund (KWTBB) Surcharge = 1.6% × [(kWh+kW) – Discounts]

The RE Fund (KWTBB) collected from the customer’s electricity bill is channelled to the Government (SEDA - Sustainable Energy Development Authority). For more information, you can visit this website: seda.gov.my

Example:

Customer A have charges on the following billing components:

Consumption for 400 kWh = RM 87.20

10 % TNB Discount = RM 8.72

RE Fund (KWTBB) Surcharge=1.6% x (87.20 – 8.72)=RM 1.26 -

1% Late Payment Surcharge

When it is imposed

The penalty charge will be imposed if payment is made later than 30 days after the bill dateHow it is calculated

The amount is calculated based on 1% (simple interest) of the outstanding bill amount, multiplied by number of days outstanding.Waivers

This penalty cannot be waived unless proven to be an administrative error on TNB’s part.How to Avoid it

Please pay your bill within 30 days from the bill date.Example:

Total billed amount: RM1,000.00

Bill date: 1 May 2018

Date of payment: 10 June 2018

Days outstanding: 10 days

So, the penalty charge=RM1,000 x 1% x (10/30)=RM 3.33 -

Connected Load Charges (CLC) / Caj Sambungan Beban

Connected Load Charge is a mitigating tool to discourage consumers from over declaring their load requirement. Over declaration will lead to over plant up and waste of resources and increase in reserve margin. Without CLC, other consumers will have to also pay for the unnecessary higher costs of electricity due to wastage and this is unfair to those who do properly declare.

Other utilities who do not have CLC penalty, recover their demand component or fix cost via imposing contract capacity charge through their tariff rate based on consumer declaration.

The revised CLC policy, which was approved by the Government, has been implemented effective from 15 January 2021.

Consumer Category for CLC

-

New Consumer:

New consumers who require medium and high voltage supply (1kV and above) will be subjected to CLC for six (6) years from the date the supply is connected. Consumers who are classified under the new consumer category are as follows:i. Medium and high voltage consumers who apply for a supply in a premise with ready electrical infrastructure or require new electrical infrastructure. ii. Low voltage consumers who apply for a supply upgrade from low voltage to medium or high voltage systems. -

Upgrading Consumer:

Existing medium and high voltage consumers who apply for an additional load and/or voltage upgrade will be subjected to CLC for five (5) years from the date the additional load and/or voltage upgrade is connected. -

Change of Tenancy (COT) Consumer:

New medium voltage and high voltage consumers who apply for a Change of Tenancy to the existing premise with active accounts will be subject to CLC based on scenarios.

CLC Calculation

-

New Consumer

Consumer is subjected to CLC for a period of 6 years from the date the supply is connected.

Consumer who take supply after 15 January 2021 has to declare the Maximum Demand (MD) in staggered, once (for CLC calculation purposes) for year one (1) until year four (4) upon supply application. Total declared MD will be used to calculate CLC for year five (5) and six (6).

For application at Kedai Tenaga, kindly complete the MD Declaration Form-New Consumer for staggered MD declaration and submit it during supply application.

CLC is applicable when the actual recorded MD in any month is less than 85% of the declared staggered MD during year 1 to year 4 and less than 75% of the total declared MD in year 5 and year 6.

The method in determining Reference Maximum Demand for calculating CLC are as follows:

Year of CLC Reference Maximum Demand 1 85% x Staggered MD declared for year 1 or the highest recorded MD, whichever is higher 2 85% x Staggered MD declared for year 2 or the highest recorded MD, whichever is higher 3 85% x Staggered MD declared for year 3 or the highest recorded MD, whichever is higher 4 85% x Staggered MD declared for year 4 or the highest recorded MD, whichever is higher 5 75% x Final MD declared or the highest recorded MD, whichever is higher 6 75% x Final MD declared or the highest recorded MD, whichever is higher Determination of Reference MD for New Consumer

- Note:

i. CLC is applicable when actual recorded MD < Reference MD. ii. If actual recorded MD is higher than declared MD (Highest Recorded MD, HMD), the HMD will replace the declared MD for the year and following year (compared with the declared MD, whichever is higher). Reference MD will be revised using the new declared MD starting from the next billing cycle.

-

Upgrading Consumer

Consumer is subjected to the new CLC for a period of 5 years from the date the additional supply is connected.

Consumer has to declare the Maximum Demand (MD) in staggered, once (for CLC calculation purposes) for year one (1) until year three (3) upon supply application. Total declared MD will be used to calculate CLC for year four (4) and five (5).

For application at Kedai Tenaga, kindly complete this MD Declaration Form-Upgrading for staggered MD declaration and submit it during supply application.

CLC is applicable when the actual recorded MD in any month is less than 85% of the declared MD in staggered during year 1 to year 3 and less than 75% of the total declared MD in year 4 and year 5.

The method in determining Reference Maximum Demand for calculating CLC are as follows:

Year of CLC Reference Maximum Demand 1 85% x Staggered MD declared for year 1 or the highest recorded MD, whichever is higher 2 85% x Staggered MD declared for year 2 or the highest recorded MD, whichever is higher 3 85% x Staggered MD declared for year 3 or the highest recorded MD, whichever is higher 4 85% x Staggered MD declared for year 4 or the highest recorded MD, whichever is higher 5 75% x Final MD declared or the highest recorded MD, whichever is higher 6 75% x Final MD declared or the highest recorded MD, whichever is higher Determination of Reference MD for New Consumer

- Note:

i. CLC is applicable when actual recorded MD < Reference MD. ii. If actual recorded MD is higher than declared MD (Highest Recorded MD, HMD), the HMD will replace the declared MD for the year and following year (compared with the declared MD, whichever is higher). Reference MD will be revised using the new declared MD starting from the next billing cycle.

-

Change of Tenancy (COT) Consumer

There are some scenarios in determining the CLC period for COT application.

Should the CLC period of previous consumer has ended:

i. If the new final MD declared by a new consumer is equal or lower than previous MD, no CLC will be imposed to the new consumer. ii. If the new final MD declared by a new consumer is higher than previous MD, the consumer will be subjected to the new CLC for a period of 6 years from the date of COT. (refer New Consumer terms).

Should the CLC period of previous consumer still active:

i. For a 6-years CLC period and still in years 1 to 4 CLC: New consumer will continues the remaining CLC period of the previous consumer. New consumer has an option to maintain the existing declared staggered MD or declare new staggered MD for the remaining CLC period up to year 4. ii. For a 5-years CLC period and still in years 1-3 CLC: New consumer will continues the remaining CLC period of the previous consumer. New consumer has an option to maintain the existing declared staggered MD or declare new staggered MD for the remaining CLC period up to year 3. iii. If the new final declared MD (MD year 5 and 6 / MD year 4 and 5) is lower (within same voltage level) or higher than previous MD, the new consumer will be subjected to the new CLC for a period of 6 years from the date of COT. (refer New Consumer terms). The new consumer will also be subjected for the cost of any reconfiguration or additional infrastructure works, if any.

For application at Kedai Tenaga, kindly check the existing declared MD and CLC period for the previous consumer and complete this MD Declaration Form-COT and submit it during supply application.

Charges

CLC rate of RM8.50/kW will be charged for every kW shortfall between the Actual Maximum Demand recorded compared to the Reference Maximum Demand (RMD) and subjected to prevailing changes from time to time.

CLC is calculated on monthly basis and displayed in the consumer’s bill (if any).

Example of CLC calculation:

New Consumer:

Total declared MD : 10,000 kW

Staggered declared MD :

Year 1 : 2,000 kW

Year 2 : 5,000 kW

Year 3 : 7,000 kW

Year 4 : 8,000 kW

YEAR MAXIMUM DEMAND DECLARED REFERENCE MAXIMUM DEMAND (RMD) ACTUAL MAXIMUM DEMAND (AMD) CLC PENALTY (RM) 1 2,000kW 85% x 2,000kW = 1,700kW 1,200kW RM8.50 x (1,700kW – 1,200kW) = RM4,250 2 5,000kW 85% x 5,000kW = 4,250kW 4,800kW No penalty. AMD > RMD 3 7,000kW 85% x 7,000kW = 5,950kW 5,250kW RM8.50 x (5,950kW - 5,250kW) = RM5,950 4 8,000kW 85% x 8,000kW = 6,800kW 7,000kW No penalty. AMD > RMD 5 10,000kW 75% x 10,000kW = 7,500kW 8,000kW No penalty. AMD > RMD 6 10,000kW 75% x 10,000kW = 7,500kW 8,200kW No penalty. AMD > RMD Assumption: Actual Maximum Demand (MD) recorded in 1 month within a CLC year

Upgrading Consumer:

Existing MD : 10,000 kW

Additional MD : 5,000kW

Total declared MD : 15,000kW

Staggered declared MD:

Year 1 : 7,500 kW (minimum - declared MD Y1, 2 and 3 must not be lower than 75% from previous declared amount)

Year 2 : 11,000 kW

Year 3 : 13,000 kW

YEAR MAXIMUM DEMAND DECLARED REFERENCE MAXIMUM DEMAND (RMD) ACTUAL MAXIMUM DEMAND (AMD) CLC PENALTY (RM) 1 7,500kW 85% x 7,500kW = 6,375kW 8,600kW No penalty. AMD > RMD 2 11,000kW 85% x 11,000kW = 9,350kW 9,500kW No penalty. AMD > RMD 3 13,000kW 85% x 13,000kW = 11,050kW 10,700kW RM8.50 x (11,050kW - 10,700kW) = RM2,975 4 15,000kW 75% x 15,000kW = 11,250kW 11,200kW RM8.50 x (11,250kW - 11,200kW) = RM425 5 15,000kW 75% x 15,000kW = 11,250kW 12,000kW No penalty. AMD > RMD

Few activities could be carried out by customers that assist in reducing MD charges such as:Practicing demand side management such as peak shift i.e. shifting their peak operation/consumption to off peak period as MD charges is not applicable during off-peak period for customers with Time of Use (ToU) tariff.

Starts motor/equipment in stages or during off-peak period.

-

-

Welding Set Surcharge / Caj Alat Kimpal

This information is valid until 30 June 2025. In line with the Electricity Tariff Restructuring effective from 1 July 2025, please visit https://www.mytnb.com.my/tariff for the latest updates

In addition to the appropriate tariff rate, there will be a surcharge for transformer-operated electric welding equipment installed for low voltage consumers at RM3.00 per kVA per month, and for medium and high voltage consumers at RM2.00 per kVA per month. Motor-operated welding sets are exempted from the foregoing surcharge.

For more information, refer to FAQ.Example:

An industry low voltage customers has welding set usage of 67.86 kVA in his Jan 2018 bill with billing period of 31 days

Welding Set Surcharge=67.86 kVA x RM3.00=RM 203.58Welding Set Load (kVA)40 -

Power Factor Surcharge / Caj Angkadar Kuasa

This information is valid until 30 June 2025. In line with the Electricity Tariff Restructuring effective from 1 July 2025, please visit https://www.mytnb.com.my/tariff for the latest updates

A Power factor surcharge is imposed when your power factor is less than 0.90 (electricity supply 132kV and above) or less than 0.85 (electricity supply below 132 kV).

Calculation to determine Power Factor

kWh / √ (kWh2 + kVARh2)Power factor surcharge for customers with electricity supply below 132 kV is calculated as follows:-

1.5% surcharge of the current bill – for every 0.01 less than 0.85 power factor

[[(0.85 – PF)/0.01] x 1.5% ] x [RM kWh + RM kW + RM ICPT]3% surcharge of the current bill – for every 0.01 less than 0.75 power factor

[[(0.85 – 0.75)/0.01] x 1.5% ] +[[(0.75 – PF)/0.01] x 3% ]] x [RM kWh + RM kW + RM ICPT]

For more information, refer to Power Factor FAQ.Example 1:

Consumption used by Customer A is 3,500 kWh where the power factor is 0.73. The ICPT rate is RM 0.0135

Total consumption (RM) = RM1,531.30

ICPT (RM)=3,500 x RM 0.0135=RM 47.25Power Factor surcharge=[[{(0.85 – 0.75)/0.01} x 1.5%] + [{(0.75 = 0.73)/0.01} x 3%]] x (RM 1,531.30 + (RM 47.25))=RM 331.50Example 2:

Consumption used by Customer B is 3,500 kWh where the power factor is 0.80. The ICPT rate is RM 0.0135

Total consumption (RM) = RM1,531.30

ICPT (RM)=3,500 x RM 0.0135=RM 47.25Power Factor surcharge=[{(0.85 – 0.80)/0.01}x 1.5%] x (RM 1,531.30 + (RM 47.25))=RM118.39 -

10% TNB Discount

The below organizations/learning/worships center are eligible to a 10% discount on their monthly bills:

1. Welfare organizations such as orphanage and elderly home, home for the blind and disable, spastic’s center that are fully funded and administered by Ministry of Women, Family and Community Development or such institutions with source of income funded by public donation

2. All government and private institutions of learning which are fully or partly funded by the government and normally administered by Ministry of Education.

3. Places of worship registered under Registrar of Societies and/or its respective religious governing body such as State/Federal Islamic Religious Council/Department, Malaysian Buddhist Association, Malaysian Hindu Sangam, Sikh Naujawan Sabha, Sikh Youth Movement, Buku Panduan Katholik and Buku Panduan Gereja Malaysia dan Brunei.

The formula for TNB Discounts is as below:

TNB Discount = 10% x (Consumption charges + ICPT)

Note: Customers in the mining tariff category are entitled to a 25% discount on their monthly bills.

Example :

The April 2018 bill for Sek Keb A shows

Consumption charges (kWh) in RM = RM231.80

ICPT (RM 0.0135) = RM 8.11

Diskaun TNB=10% x (RM231.80 + RM 8.11)=RM 23.99 -

Prorate Factor

Proration factor applied by TNB will benefit the customers whose meters are read above 35 days

Proration Factor = Number of billing days / 30

Prorated Factor will be multiplied with each tariff block for low voltage customer. Customer will benefit lower rate for expanded consumption block range.

Example :

Low Voltage Customer receives Jan 2018 bill with 38 days billing period with consumption 850 kWh

Proration Factor=38/30=1.26667Consumption block (default) Usage (kWh) - Prorated Rate (RM/kWh) 200 200 x 1.26667 = 253 0.4350 > 200 850 – 253 = 597 0.5090 Total Consumption Rate=(253 x 0.4350) + (597 x 0.5090)=RM 413.87